Part 1—Preliminary

1 Name

This instrument is the Bankruptcy Regulations 2021.

3 Authority

This instrument is made under the Bankruptcy Act 1966.

4 Definitions

Note: A number of expressions used in this instrument are defined in the Act, including the following:

(a) approved form;

(b) registered trustee;

(c) Registrar;

(d) the Court;

(e) the Official Receiver.

In this instrument:

Act means the Bankruptcy Act 1966.

charge period has the same meaning as in the Bankruptcy (Estate Charges) Act 1997.

contribution assessment period has the meaning given by section 139K of the Act.

controlling trustee has the meaning given by Part X of the Act.

current condition has the meaning given by section 5‑10 of Schedule 2 to the Act.

electronic communication means an electronic communication within the meaning of paragraph (a) of the definition of electronic communication in subsection 5(1) of the Electronic Transactions Act 1999.

estate charge means:

(a) interest charge; or

(b) realisations charge.

FBTA Act means the Fringe Benefits Tax Assessment Act 1986 as in force at the start of 1 July 1992.

Fees and Remuneration Determination means the determination in force under subsection 316(1) of the Act.

Index means the National Personal Insolvency Index established under section 73.

infringement notice means an infringement notice given under section 90.

infringement notice provision means an offence of a kind referred to in the table in subsection 277B(2) of the Act.

interest charge has the same meaning as in Part XV of the Act.

late payment penalty has the same meaning as in Part XV of the Act.

legal practitioner means a barrister, a solicitor, a barrister and solicitor or a legal practitioner, of the High Court or of the Supreme Court of a State or Territory.

preliminary remuneration and expenses of a trustee in relation to a debtor means:

(a) remuneration paid to the trustee in accordance with a direction, or other order, made by the Court under subsection 50(1) of the Act directing the trustee to take control of the debtor’s property or making another order in relation to the property; and

(b) any expenses incurred by the trustee:

(i) as a result of that direction or other order; or

(ii) in relation to the examination of the debtor, or an examinable person in relation to the debtor, as a result of the issue of a summons under subsection 50(2) of the Act.

realisations charge has the same meaning as in Part XV of the Act.

regulated debtor has the meaning given by section 5‑15 of Schedule 2 to the Act.

Part 2—Administration

5 Disclosure of information by Inspector‑General

For the purposes of paragraph 12(4)(b) of the Act, the following professional disciplinary bodies are prescribed:

(a) Chartered Accountants Australia and New Zealand;

(b) CPA Australia;

(c) the Australian Restructuring Insolvency and Turnaround Association;

(d) the Institute of Public Accountants;

(e) the New South Wales Bar Association;

(f) The Law Society of New South Wales;

(g) the Victorian Legal Services Commissioner;

(h) the Victorian Legal Services Board;

(i) the Bar Association of Queensland;

(j) the Queensland Law Society;

(k) the Legal Practice Board of Western Australia;

(l) the Law Society of South Australia;

(m) the Legal Profession Conduct Commissioner of South Australia;

(n) the Law Society of Tasmania;

(o) the Law Society of the Australian Capital Territory;

(p) the Law Society Northern Territory.

6 Prescribed rate of interest on money held in Common Fund

For the purposes of section 20J of the Act, the rate of interest prescribed is 7% per year.

Note: This rate is referred to in subsections 20J(2) and (4) of the Act.

Part 3—Courts

7 Prescribed countries

For the purposes of subsection 29(5) of the Act, the following countries are prescribed:

(a) Jersey;

(b) Malaysia;

(c) Papua New Guinea;

(d) Singapore;

(e) Switzerland;

(f) the United States of America.

Part 4—Proceedings in connection with bankruptcy

Division 1—Bankruptcy notices

8 Application for bankruptcy notice

(1) This section sets out the requirements for an application to the Official Receiver for a bankruptcy notice by a person who has obtained against a debtor one, or 2 or more, final judgments or final orders of a kind described in paragraph 40(1)(g) of the Act.

Note: Subsection 40(3) of the Act sets out several deeming rules for the purposes of paragraph 40(1)(g) of the Act.

(2) The application must be in the approved form.

(3) The application must specify the final judgment or final order or each of those final judgments or final orders.

(4) The application must include:

(a) if any final order specified in the application is an award that is a final order because of subparagraph 40(3)(a)(i) of the Act—both of the following:

(i) a copy of the award certified as a true copy by the arbitrator who made the award or by an officer of the Court who has compared the copy with the original award;

(ii) a sealed or certified copy of the order giving leave to enforce the award; and

(b) for any other final order or final judgment specified in the application—at least one of the following:

(i) a copy of the sealed or certified judgment or order;

(ii) a certificate of the judgment or order sealed by the court that made the judgment or order (the relevant court) or signed by an officer of the relevant court;

(iii) a copy of the entry of the judgment or order certified as a true copy of that entry and sealed by the relevant court or signed by an officer of the relevant court.

Note 1: For bankruptcy notices, see section 9 and Schedule 1.

Note 2: A fee is payable to the Official Receiver for an application under this section (see the Fees and Remuneration Determination).

9 Form of bankruptcy notice

(1) For the purposes of subsection 41(2) of the Act, the form of bankruptcy notice set out in Schedule 1 is prescribed.

(2) A bankruptcy notice must follow that form in respect of its format (for example, bold or italic typeface, underlining and notes).

(3) Subsection (2) does not limit section 25C of the Acts Interpretation Act 1901.

Note: Section 25C of the Acts Interpretation Act 1901 provides that strict compliance with a form is not required and substantial compliance is sufficient.

10 Service of bankruptcy notice

(1) A bankruptcy notice in relation to a debtor must be served on the debtor within:

(a) the 6 month period beginning on the day that the Official Receiver issues the notice; or

(b) any additional period that the Official Receiver determines in writing for the purposes of this paragraph.

Note: If paragraph (b) applies, a fee is payable under the Fees and Remuneration Determination.

(2) A bankruptcy notice in relation to a debtor that is served on the debtor outside of a period mentioned in subsection (1) is not valid.

10A Prescribed statutory minimum

For the purposes of paragraph (a) of the definition of statutory minimum in subsection 5(1) of the Act, the amount prescribed is $10,000.

11 Inspection of bankruptcy notice

(1) Subject to subsection (2), the only persons who may inspect a bankruptcy notice issued by the Official Receiver under subsection 41(1) of the Act are the following:

(a) a person specified in the notice;

(b) a party to a proceeding to which the notice relates;

(c) a legal practitioner acting on behalf of a person mentioned in paragraph (a) or (b) of this subsection.

(2) If a creditor’s petition is presented that is founded on an act of bankruptcy consisting of failure to comply with the bankruptcy notice, any person may inspect the notice.

12 Judgment or order in foreign currency

(1) This section applies in relation to a bankruptcy notice issued by the Official Receiver in relation to a debtor if the notice includes a final judgment, or final order, that is expressed in an amount of foreign currency (whether or not the judgment or order is also expressed in an amount of Australian currency).

(2) The bankruptcy notice must include the following:

(a) a statement to the effect that the debtor must pay:

(i) the amount of foreign currency; or

(ii) the equivalent amount of Australian currency;

(b) the conversion calculation for the equivalent amount of Australian currency;

(c) a statement to the effect that the conversion of the amount of foreign currency into the equivalent amount of Australian currency has been made in accordance with this section.

(3) For the purposes of subparagraph (2)(a)(ii), the equivalent amount of Australian currency is the amount worked out using the rate of exchange for the foreign currency published by the Reserve Bank of Australia in relation to the day that is 2 business days before the day on which the application for the notice is made.

Note: The Reserve Bank of Australia exchange rates could in 2021 be viewed on the Reserve Bank of Australia’s website (http://www.rba.gov.au).

Division 2—Petitions

13 Copy of petition, and certain orders, to be given to Official Receiver

A creditor who presents a petition to the Court under Division 2 of Part IV of the Act must give to the Official Receiver:

(a) a copy of the petition within 2 business days after the Court files the petition; and

(b) a copy of any order entered by the Court, dismissing, staying or extending the petition, or adjourning the hearing of the petition, within 2 business days after the Court enters the order.

14 Control of debtor’s property before sequestration

(1) If the Court gives a direction, or makes another order, under subsection 50(1) of the Act in relation to a debtor, the creditor who applied under subsection 50(1A) of the Act for the Court to make a direction must:

(a) serve the documents specified in subsection (2) of this section on both of the following:

(i) the trustee who the Court has directed to take control of the debtor’s property;

(ii) the Official Receiver; and

(b) do so within 2 business days after the Court gives the direction or makes the order as the case may be.

Note: A direction under subsection 50(1) of the Act may be given to the Official Trustee or a registered trustee.

(2) The following documents are specified:

(a) a copy of the application;

(b) a copy of any affidavit filed in support of the application;

(c) a certified copy of the direction or order as the case may be.

15 Preliminary remuneration and expenses of trustee

Scope

(1) This section applies if:

(a) a creditor applies under subsection 50(1A) of the Act for the Court to make a direction in relation to a debtor; and

(b) the Court, under subsection 50(1) of the Act, directs a trustee to take control of the debtor’s property or makes another order in relation to the property; and

(c) in accordance with the direction or other order, the creditor deposits an amount (the first amount) with the trustee for the purposes of covering the preliminary remuneration and expenses of the trustee in relation to the debtor.

Note: A direction under subsection 50(1) of the Act may be given to the Official Trustee or a registered trustee.

Refund to creditor of amounts deposited in excess of preliminary remuneration and expenses

(2) The creditor is entitled to a refund of the sum of the first amount and any amount covered by subsection (4) less an amount equal to the preliminary remuneration and expenses of the trustee in relation to the debtor if any of the following events occur:

(a) the debtor enters into a personal insolvency agreement, or the debtor’s estate is administered under Part XI of the Act, and the Court authorises the trustee to transfer the debtor’s property to some other person;

(b) a sequestration order is made against the estate of the debtor;

(c) if a creditor’s petition was presented in relation to the debtor—the creditor’s petition is dismissed;

(d) a debtor’s petition relating to the debtor is accepted by the Official Receiver;

(e) a proposal by the debtor relating to a debt agreement is accepted under section 185EC of the Act.

(3) The trustee must pay a refund payable under subsection (2) to the creditor.

Additional amounts

(4) An amount (the additional amount) is covered by this subsection if:

(a) both of the following apply:

(i) the trustee requests the creditor to deposit with the trustee the additional amount in addition to the first amount;

(ii) the creditor deposits the additional amount with the trustee; or

(b) all of the following apply:

(i) the Court is satisfied that the first amount is insufficient to cover the preliminary remuneration and expenses of the trustee in relation to the debtor;

(ii) the Court, under subsection 50(1) of the Act, directs, on application by the trustee, the creditor to deposit the additional amount with the trustee;

(iii) the creditor deposits the additional amount with the trustee.

16 Application for damages where petition dismissed

(1) This section applies if:

(a) a creditor’s petition is presented to the Court in relation to a debtor; and

(b) the Court, under subsection 50(1) of the Act, directs a trustee to take control of the debtor’s property or makes another order in relation to the property; and

(c) the Court subsequently dismisses the creditor’s petition.

Note: The trustee could be the Official Trustee or a registered trustee (see subsection 50(1) of the Act).

(2) The Court may, on application by the debtor within 15 business days after the day the petition is dismissed, order the creditor to pay the debtor an amount equal to the damage the Court assesses as resulting from the acts or omissions of the trustee in reliance on the direction or other order mentioned in paragraph (1)(b).

17 Prescribed modifications of applied provisions

For the purposes of subsection 50(5) of the Act, section 81 of the Act is modified as follows:

(a) by omitting from subsection (2) “An” and substituting “Subject to subsection (2A), an”;

(b) by inserting after subsection (2) the following subsection:

“(2A) The Court or a magistrate may direct that an examination, or any part of an examination, under this section shall be held in private.”;

(c) by omitting from subsection (9) “is the trustee” and substituting “has been directed to take control of the property of the relevant person”;

(d) by omitting subsection (10A);

(e) by omitting subsection (14) and substituting the following subsections:

“(14) Subject to subsection (14A), the applicant for an examination under this section is to pay the costs incurred in connection with the examination.

(14A) The Court or a magistrate may order that all or some of the costs mentioned in subsection (14) are to be paid by the relevant person.”.

18 Acceptance of debtor’s declaration

If:

(a) a debtor presents a declaration under section 54A of the Act; and

(b) the Official Receiver accepts the declaration, and signs a copy of the declaration, under paragraph 54C(1)(a) of the Act;

the Official Receiver must give a copy of the signed copy of the declaration to the debtor.

19 Prescribed information to be supplied by Official Receiver to debtor

(1) For the purposes of subsections 54D(1), 55(3A), 56B(5) and 57(3A) of the Act, the following information is prescribed:

(a) information about alternatives to bankruptcy;

(b) information about the consequences of bankruptcy;

(c) information about sources of financial advice and guidance to persons facing or contemplating bankruptcy;

(d) information about a debtor’s right to choose whether the bankruptcy is initially administered by a registered trustee or the Official Trustee;

(e) a statement that it is an act of bankruptcy for a debtor to present to the Official Receiver, under section 54A of the Act, a declaration of intention to present a debtor’s petition.

(2) The information must be factual and objective.

20 Presentation of debtor’s petition

(1) This section applies if a debtor intends to present a petition under section 55, 56B or 57 of the Act and the debtor is:

(a) unable to read the relevant material because the debtor:

(i) is blind or has low vision; or

(ii) is illiterate or partially literate; or

(iii) is insufficiently familiar with the English language; or

(b) unable to sign the petition because of a physical incapacity.

(2) The petition may be signed on behalf of the debtor by another person, who must also sign a statement:

(a) if subparagraph (1)(a)(i) or (ii) applies—that the person has read the relevant material to the debtor; or

(b) if subparagraph (1)(a)(iii) applies—that the person has interpreted the relevant material to the debtor in a language with which the person and the debtor are familiar; or

(c) if paragraph (1)(b) applies—that the person believes that the debtor has read and understood the relevant material.

(3) In this section:

relevant material means the petition and the information prescribed under section 19.

21 Debtor’s petition—filing of trustee’s consent

If:

(a) a debtor presents, or 2 or more debtors present, a petition to the Official Receiver under section 55, 56B or 57 of the Act; and

(b) there is in force under subsection 156A(1) of the Act an instrument of consent of a registered trustee to act as the trustee of:

(i) the estate of the debtor; or

(ii) in the case of 2 or more debtors—the separate estates, the joint estates, or the joint and separate estates, of the debtors or any of them;

the petition must include the original, or a clearly legible copy, of the instrument of consent.

22 Notice to partners of referral to Court of petition by other partners against the partnership

(1) For the purposes of subsection 56C(2) of the Act, if the Official Receiver refers a debtor’s petition against a partnership to the Court, the notice given by the Official Receiver to each member of the partnership who did not present the petition must:

(a) be in writing; and

(b) state that the petition has been referred to a court specified in the notice; and

(c) specify the day, time and place of hearing of the petition.

(2) The Official Receiver must give the notice at least 5 business days before the day of the hearing.

Note: See section 102 of this instrument (service of documents).

Part 5—Control over person and property of debtors and bankrupts

23 Arrest of debtor or bankrupt

If a person is arrested under a warrant issued by the Court under section 78 of the Act, the arresting officer must immediately notify a Registrar of the Court.

Part 6—Administration of property

Division 1—Proof of debts

24 Proof of debt in foreign currency

(1) This section applies if:

(a) a creditor lodges, or causes to be lodged, a proof of debt in a bankruptcy in accordance with section 84 of the Act; and

(b) the debt is an amount of foreign currency.

(2) The proof of debt must include the following:

(a) a statement of:

(i) the amount of foreign currency; and

(ii) the equivalent amount of Australian currency; and

(iii) the conversion calculation for the equivalent amount of Australian currency;

(b) a statement to the effect that the conversion of the amount of foreign currency into the equivalent amount of Australian currency has been made in accordance with this section.

(3) For the purposes of subparagraph (2)(a)(ii), the equivalent amount of Australian currency is the amount worked out using the rate of exchange for the foreign currency published by the Reserve Bank of Australia in relation to the day that is 2 business days before the date of the bankruptcy.

Note: The Reserve Bank of Australia exchange rates could in 2021 be viewed on the Reserve Bank of Australia’s website (http://www.rba.gov.au).

Division 2—Order of payment of debts

25 Priority payments—order of payment of certain costs, charges, expenses and remuneration

(1) For the purposes of paragraph 109(1)(a) of the Act, the order that the trustee of the estate of a bankrupt must apply the proceeds of the bankrupt’s property to the costs, charges, expenses and remuneration mentioned in the following table is the order that appears in the table.

Order of payment of certain costs, charges, expenses and remuneration |

Item | Costs, charges and expenses |

1 | Realisations charge payable by the trustee in relation to the estate under the Bankruptcy (Estate Charges) Act 1997 |

2 | If the trustee is a registered trustee to whom the Official Trustee transferred the administration of the bankruptcy, both of the following in relation to the administration of the bankruptcy by the Official Trustee before the transfer: (a) any remuneration payable to the Official Trustee under the Fees and Remuneration Determination; (b) any reimbursement that is payable to the Official Trustee under section 108 |

3 | Expenses reasonably incurred by or on behalf of the trustee: (a) in protecting all or part of the bankrupt’s assets; or (b) in carrying on, in accordance with the Act, a business of the bankrupt |

4 | If a creditor made an advance to the trustee for the purposes of the trustee’s administration of the bankruptcy—an amount, payable to the creditor, equal to that advance |

5 | Fees, costs, charges or expenses (other than fees, costs, charges or expenses covered by another item of this table) paid or payable by the trustee in administering the bankrupt’s estate |

6 | If: (a) an order was made under subsection 50(1) of the Act in relation to the bankrupt when the bankrupt was a debtor; and (b) an amount was deposited by a creditor, in accordance with that order, with the trustee; an amount, payable to the creditor, equal to the trustee’s preliminary remuneration and expenses in relation to the debtor |

7 | The following: (a) if a creditor applied for: (i) a sequestration order against the estate; or (ii) an order for the administration of the estate under Part XI of the Act; the taxed costs of the creditor in relation to the application; (b) if the administrator of the estate of a deceased person presented a petition for an order for the administration of the estate under Part XI of the Act—the taxed costs of the administrator; (c) if a person made an application for a sequestration order under Part X of the Act—both of the following: (i) the taxed costs of that person in relation to the application; (ii) any taxed costs of that person in respect of an application for an order under Division 5 or 6 of Part IX of the Act in relation to the estate |

8 | The trustee’s remuneration (other than remuneration covered by item 6): (a) if the trustee is the Official Trustee—payable to the Official Trustee under the Fees and Remuneration Determination; or (b) if the trustee is a registered trustee—payable to the registered trustee under section 60‑5 of Schedule 2 to the Act |

9 | If: (a) there is a committee of inspection in relation to the administration of the estate; and (b) the creditors of the estate, or a majority of them, have approved payment of out‑of‑pocket expenses incurred by a member of the committee of inspection; those expenses, to the extent that the trustee allows them as being fair and reasonable |

10 | Costs of any audit carried out under section 70‑15 or 70‑20 of Schedule 2 to the Act in relation to the estate |

References to certain applicants and petitioners where debtor’s petition accepted

(2) For the purposes of item 7 of the table, a reference to an applicant or a person presenting a petition is taken to include a reference to a person whose application or petition has not been proceeded with because a debtor’s petition presented by the bankrupt has been accepted by the Official Receiver (whether or not that debtor’s petition was referred to the Court under subsection 55(3B) of the Act, and whatever the outcome of such a referral).

26 Maximum amount payable to employee

For the purposes of paragraph 109(1)(e) of the Act, the maximum amount due to or in respect of an employee of a bankrupt is:

(a) if the date of the bankruptcy is in a financial year specified in column 1 of an item of the following table—the amount specified in column 2 of that item; or

(b) if the date of the bankruptcy is in the financial year beginning on 1 July 2020—$4,600; or

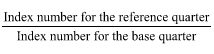

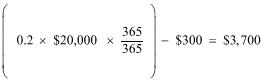

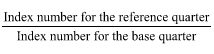

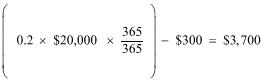

(c) if the date of the bankruptcy is in the financial year beginning on 1 July 2021 or a later financial year—$4,600:

(i) indexed in accordance with section 114 of this instrument; and

(ii) rounded down to the nearest multiple of $50.

Note: Indexed amounts could in 2021 be viewed on the Australian Financial Security Authority’s website (http://www.afsa.gov.au).

Maximum amount payable to employee |

Item | Column 1 Financial year | Column 2 Amount |

1 | 2019‑20 | $4,600 |

2 | 2018‑19 | $4,550 |

3 | 2017‑18 | $4,500 |

4 | 2016‑17 | $4,450 |

5 | 2015‑16 | $4,400 |

6 | 2014‑15 | $4,350 |

7 | 2013‑14 | $4,300 |

8 | 2012‑13 | $4,200 |

9 | 2011‑12 | $4,150 |

10 | 2010‑11 | $4,100 |

11 | 2009‑10 | $4,000 |

12 | 2008‑09 | $3,950 |

13 | 2007‑08 | $3,850 |

14 | 2006‑07 | $3,750 |

15 | 2005‑06 | $3,650 |

16 | 2004‑05 | $3,550 |

17 | 2003‑04 | $3,500 |

18 | 2002‑03 | $3,450 |

19 | 2001‑02 | $3,350 |

20 | 2000‑01 | $3,300 |

21 | 1999‑2000 | $3,150 |

22 | 1998‑99 | $3,100 |

23 | 1997‑98 | $3,100 |

24 | 1996‑97 | $3,100 |

Division 3—Property available for payment of debts

27 Household property that is not available for payment of debts

Property to which subsection 116(1) of the Act does not extend

(1) For the purposes of subparagraph 116(2)(b)(i) of the Act, the following kinds of property are prescribed:

(a) basic household property of a kind covered by subsection (2);

(b) property of a kind covered by subsection (3) to the extent that it is reasonably appropriate for a household, having regard to the criteria specified in subsection (4);

(c) property (including recreational and sports equipment) of a kind that is reasonably necessary for the domestic use of a household, having regard to:

(i) current social standards; and

(ii) the criteria specified in subsection (4).

Basic household property

(2) This subsection covers the following:

(a) sufficient household furniture for the members of the household;

(b) sufficient beds for the members of the household;

(c) educational, sporting or recreational items (including books) that are wholly or mainly for the use of children or students in the household;

(d) one television set;

(e) one set of stereo equipment;

(f) one radio;

(g) either:

(i) one washing machine and one clothes drier; or

(ii) one combined washing machine and clothes drier;

(h) either:

(i) one refrigerator and one freezer; or

(ii) one combined refrigerator and freezer;

(i) one generator, if relied on to supply electrical power to the household;

(j) one telephone;

(k) one appliance or console used for home entertainment;

(l) one personal computer;

(m) one set of equipment providing internet access to the members of the household.

Property that is reasonably appropriate for a household

(3) This subsection covers the following:

(a) kitchen equipment;

(b) cutlery;

(c) crockery;

(d) foodstuffs;

(e) heating equipment;

(f) cooling equipment;

(g) telephone equipment;

(h) fire detectors and extinguishers;

(i) anti‑burglar devices;

(j) bedding;

(k) linen;

(l) towels;

(m) other household effects.

Criteria

(4) The following criteria are specified for the purposes of paragraph (1)(b) and subparagraph (1)(c)(ii):

(a) the number and ages of members of the household;

(b) any special health or medical needs of any of those members;

(c) any special climatic or other factors (including geographical isolation) of the place where the household residence is located;

(d) whether the property is reasonably necessary for the functioning or servicing of the household as a viable and properly‑run household;

(e) whether the costs of seizure, storage and sale of the property would be likely to exceed the sale price of the property;

(f) if paragraph (e) does not apply—whether for any other reason (for example, costs of transport) the sale of the property would be likely to be uneconomical.

Antique items

(5) Nothing in this section prevents subsection 116(1) of the Act from extending to antique items.

(6) For the purposes of subsection (5), an item is an antique item only if a substantial part of its market value is attributable to its age or historical significance.

28 Personal property with sentimental value that is not available for payment of debts

For the purposes of subparagraph 116(2)(ba)(ii) of the Act, non‑monetary sporting, cultural, military or academic awards are a kind of property that is prescribed.

29 Tools that are not available for payment of debts

For the purposes of subparagraph 116(2)(c)(i) of the Act, the maximum total value of a bankrupt’s property that is for use by the bankrupt in earning income by personal exertion is:

(a) if the date of the bankruptcy is in a financial year specified in column 1 of an item of the following table—the amount specified in column 2 of that item; or

(b) if the date of the bankruptcy is in the financial year beginning on 1 July 2020—$3,800; or

(c) if the date of the bankruptcy is in the financial year beginning on 1 July 2021 or a later financial year—$3,800:

(i) indexed in accordance with section 114 of this instrument; and

(ii) rounded down to the nearest multiple of $50.

Note: Indexed amounts could in 2021 be viewed on the Australian Financial Security Authority’s website (http://www.afsa.gov.au).

Maximum total value of tools |

Item | Column 1 Financial year | Column 2 Amount |

1 | 2019‑20 | $3,800 |

2 | 2018‑19 | $3,800 |

3 | 2017‑18 | $3,750 |

4 | 2016‑17 | $3,700 |

5 | 2015‑16 | $3,650 |

6 | 2014‑15 | $3,600 |

7 | 2013‑14 | $3,550 |

8 | 2012‑13 | $3,500 |

9 | 2011‑12 | $3,450 |

10 | 2010‑11 | $3,400 |

11 | 2009‑10 | $3,300 |

12 | 2008‑09 | $3,250 |

13 | 2007‑08 | $3,200 |

14 | 2006‑07 | $3,100 |

15 | 2005‑06 | $3,050 |

16 | 2004‑05 | $3,000 |

17 | 2003‑04 | $2,950 |

18 | 2002‑03 | $2,900 |

19 | 2001‑02 | $2,850 |

20 | 2000‑01 | $2,800 |

21 | 1999‑2000 | $2,650 |

22 | 1998‑99 | $2,600 |

23 | 1997‑98 | $2,600 |

24 | 1996‑97 | $2,600 |

30 Motor vehicles that are not available for payment of debts

For the purposes of paragraph 116(2)(ca) of the Act, the maximum aggregate value of property used by the bankrupt primarily as a means of transport is:

(a) if the date of the bankruptcy is in a financial year specified in column 1 of an item of the following table—the amount specified in column 2 of that item; or

(b) if the date of the bankruptcy is in the financial year beginning on 1 July 2020—$8,100; or

(c) if the date of the bankruptcy is in the financial year beginning on 1 July 2021 or a later financial year—$8,100:

(i) indexed in accordance with section 114 of this instrument; and

(ii) rounded down to the nearest multiple of $50.

Note: Indexed amounts could in 2021 be viewed on the Australian Financial Security Authority’s website (http://www.afsa.gov.au).

Maximum value of motor vehicle |

Item | Column 1 Financial year | Column 2 Amount |

1 | 2019‑20 | $8,100 |

2 | 2018‑19 | $8,000 |

3 | 2017‑18 | $7,900 |

4 | 2016‑17 | $7,800 |

5 | 2015‑16 | $7,700 |

6 | 2014‑15 | $7,600 |

7 | 2013‑14 | $7,500 |

8 | 2012‑13 | $7,350 |

9 | 2011‑12 | $7,200 |

10 | 2010‑11 | $7,050 |

11 | 2009‑10 | $6,850 |

12 | 2008‑09 | $6,700 |

13 | 2007‑08 | $6,500 |

14 | 2006‑07 | $6,300 |

15 | 2005‑06 | $6,150 |

16 | 2004‑05 | $6,000 |

17 | 2003‑04 | $5,900 |

18 | 2002‑03 | $5,800 |

19 | 2001‑02 | $5,650 |

20 | 2000‑01 | $5,500 |

21 | 1999‑2000 | $5,200 |

22 | 1998‑99 | $5,050 |

23 | 1997‑98 | $5,000 |

24 | 1996‑97 | $5,000 |

Division 4—Undervalued transactions

31 Transfers exempt from being void against trustee

For the purposes of paragraph 120(2)(d) of the Act, a transfer is of a kind to which subsection 120(1) of the Act does not apply if the costs of recovering the transferred property would, in the opinion of the trustee in the transferor’s bankruptcy, be likely to exceed the value of the property to the transferor’s creditors.

Division 5—Realisation of property

32 Disclaimer of onerous property

(1) A notice of disclaimer under subsection 133(1) or (1A) of the Act must:

(a) adequately identify both of the following:

(i) the bankrupt to whom the notice relates;

(ii) the property or contract being disclaimed; and

(b) in the case of disclaimer, without the leave of the Court, of a lease—set out facts showing that subsection 133(4) of the Act has been complied with; and

(c) in the case of disclaimer, without the leave of the Court, of a contract—set out facts showing that the contract is, for the purposes of subsection 133(5A) of the Act, an unprofitable contract.

(2) A trustee who gives a notice of disclaimer under subsection 133(1) or (1A) of the Act must give the notice to each person who, to the trustee’s knowledge:

(a) in the case of disclaimer of property—has an interest in the property; or

(b) in the case of disclaimer of a contract—is:

(i) entitled to a benefit of, or right under, the contract; or

(ii) subject to a burden or liability under the contract.

(3) A failure to comply with subsection (1) or (2) does not affect the validity of a notice of disclaimer under subsection 133(1) or (1A) of the Act.

Division 6—Definition of income

33 Fringe benefits—modification of the FBTA Act

(1) This section is made for the purposes of subparagraph (a)(v) of the definition of income in subsection 139L(1) of the Act.

(2) The FBTA Act is modified in accordance with Schedule 2 to this instrument.

(3) The FBTA Act is also modified so that it has effect as if:

(a) a reference in that Act to a year of tax were a reference to a contribution assessment period; and

(b) a reference in that Act to the taxable value of a benefit were a reference to the value, for the purposes of the Act, of the benefit; and

(c) a reference in that Act to a declaration date were a reference to the date occurring 21 days after the end of a contribution assessment period in relation to a bankrupt; and

(d) a reference in that Act to a declaration to be given to an employer of a person were a reference to a declaration to be given to the trustee of the person’s estate; and

(e) a reference in that Act to a form approved by the Commissioner were a reference to a form approved by the Inspector‑General under section 6D of the Act; and

(f) subject to paragraph (d), a reference in the FBTA Act to an employer, or to the employer, were a reference to any person (other than the bankrupt); and

(g) a reference in the FBTA Act to an employee, or to the employee, were a reference to a bankrupt, or to the bankrupt, as the case requires.

(4) The FBTA Act is also modified so that a reference (however expressed) in the FBTA Act to:

(a) the employment of an employee; or

(b) an associate of an employee;

is to be disregarded.

(5) Despite subsections (2), (3) and (4), the modifications specified or referred to in those subsections do not apply in relation to the provision of a fringe benefit (within the meaning of the FBTA Act) to a bankrupt if the provider of the fringe benefit:

(a) was the employer of the bankrupt; and

(b) provided the fringe benefit to the bankrupt in respect of the bankrupt’s employment by the provider; and

(c) was not an employer over whom the bankrupt exercised effective control, whether directly or indirectly.

34 Superannuation contributions

(1) For the purposes of subparagraph (b)(v) of the definition of income in subsection 139L(1) of the Act, the following contributions and payments made for the purpose of providing superannuation benefits for a bankrupt person are not income of the person:

(a) contributions made by, or on behalf of, each employer of the person to the extent that the contributions reduce the employer’s potential liability for the superannuation guarantee charge imposed under section 5 of the Superannuation Guarantee Charge Act 1992;

(b) contributions made by, or on behalf of, each employer of the person in accordance with the employer’s obligation to make contributions for the person under:

(i) an industrial award or determination made under a law of the Commonwealth, a State or a Territory; or

(ii) an industrial agreement registered, made or lodged under a law of the Commonwealth, a State or a Territory; or

(iii) a law of the Commonwealth, or of a State or Territory;

that exceed the contributions, made by or on behalf of the employer, mentioned in paragraph (a);

(c) payments of shortfall components made to, or for the benefit of, the person under sections 65 to 67 of the Superannuation Guarantee (Administration) Act 1992.

(2) Despite subsection (1), contributions for a contribution assessment period are taken to be income of a person if:

(a) the contributions exceed the relevant superannuation guarantee charge percentage of the employee’s ordinary time earnings for the contribution assessment period; and

(b) the employer has an obligation to make the contributions that arise under an individual industrial agreement; and

(c) the contributions are not contributions of the kind mentioned in subparagraph (1)(b)(iii).

(3) In this section:

individual industrial agreement means an industrial agreement made solely between the employer and the person, including the following:

(a) an AWA, or an ITEA, (both within the meaning of the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009) to which that Act applies;

(b) a similar agreement under the law of a State or Territory.

ordinary time earnings has the meaning given by subsection 6(1) of the Superannuation Guarantee (Administration) Act 1992.

relevant superannuation guarantee charge percentage: the relevant superannuation guarantee charge percentage for a year (the bankruptcy year) is the percentage whose number is the same as that set out in column 2 of the table in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the financial year in which the bankruptcy year starts.

shortfall component has the same meaning as in Part 8 of the Superannuation Guarantee (Administration) Act 1992.

35 Family assistance and social security payments

For the purposes of subparagraph (b)(v) of the definition of income in subsection 139L(1) of the Act, the following payments or amounts are not income of a bankrupt:

(a) a payment or amount of family tax benefit paid under the family assistance law (within the meaning of the A New Tax System (Family Assistance) (Administration) Act 1999);

(b) an amount that is not income for the purposes of the Social Security Act 1991 because of subsection 8(8) of that Act, except for a payment or amount mentioned in paragraph (a), (h), (ha), (k), (ka), (m), (z), (za) or (zb) of that subsection.

Division 7—Contributions by bankrupt

36 Contribution assessment—income of dependant

For the purposes of paragraph (c) of the definition of dependant in section 139K of the Act, the prescribed amount of income derived (or likely to be derived) by a person during a contribution assessment period is:

(a) if the period begins between 5 May 2003 and 30 June 2003—$2,500; or

(b) if the period begins in a financial year specified in column 1 of an item of the following table—the amount specified in column 2 of that item; or

(c) if the period begins in the financial year beginning on 1 July 2020—$3,741; or

(d) if the period begins in a later financial year—$3,741 indexed in accordance with section 114 of this instrument as if the period were that financial year.

Note: Indexed amounts could in 2021 be viewed on the Australian Financial Security Authority’s website (http://www.afsa.gov.au).

Maximum income of dependant |

Item | Column 1 Financial year | Column 2 Amount |

1 | 2019‑20 | $3,720 |

2 | 2018‑19 | $3,642 |

3 | 2017‑18 | $3,596 |

4 | 2016‑17 | $3,532 |

5 | 2015‑16 | $3,459 |

6 | 2014‑15 | $3,411 |

7 | 2013‑14 | $3,363 |

8 | 2012‑13 | $3,264 |

9 | 2011‑12 | $3,181 |

10 | 2010‑11 | $3,131 |

11 | 2009‑10 | $3,030 |

12 | 2008‑09 | $2,942 |

13 | 2007‑08 | $2,870 |

14 | 2006‑07 | $2,756 |

15 | 2005‑06 | $2,688 |

16 | 2004‑05 | $2,611 |

17 | 2003‑04 | $2,549 |

37 Contributions by bankrupt—modes of payment

(1) This section applies in relation to a contribution that a bankrupt:

(a) is liable to pay to the trustee of the bankrupt’s estate under subsection 139P(1) or 139Q(1) of the Act; or

(b) wishes to pay to the trustee under subsection 139P(2) or paragraph 139Q(3)(a) of the Act.

(2) The bankrupt may pay the contribution in one of the following ways:

(a) by bank draft, cheque, money order or postal order payable to the trustee and delivered or posted to that office;

(b) by deposit of the amount of the contribution in, or transfer of that amount to, the trustee’s bank account;

(c) any other method authorised in writing by the trustee.

(3) If the bankrupt pays the contribution by cheque, payment is taken to occur when the cheque is cleared and the amount of the payment is credited to the account into which the cheque is deposited.

(4) The trustee may, on reasonable notice in writing to the bankrupt, vary or withdraw an authorisation under paragraph (2)(c).

(5) If the trustee incurs a delivery or postal charge (including a surcharge) or bank charge in connection with the receipt or processing of the contribution, the trustee may reimburse the trustee for the amount of the charge from the bankrupt’s estate.

38 Contributions where bankrupt dies

(1) This section applies if:

(a) a bankrupt is liable to pay a contribution to the trustee of the bankrupt’s estate under subsection 139P(1) or 139Q(1) of the Act in respect of a contribution assessment period; and

(b) the bankrupt dies during the period.

Note: For proceedings in bankruptcy on the death of a bankrupt, see section 63 of the Act.

(2) No refund is payable in respect of any part of the contribution paid by or on behalf of the bankrupt.

(3) If the contribution remains unpaid, the deceased bankrupt’s estate is liable for the portion of the contribution attributable to the part of the period occurring before the bankrupt’s death.

39 Discharged bankrupt to give information if contribution unpaid

(1) This section applies if:

(a) a person is discharged from bankruptcy; and

(b) immediately before being discharged, the person was liable to pay a contribution to the trustee of the person’s estate under subsection 139P(1) or 139Q(1) of the Act; and

(c) the person has not paid the contribution; and

(d) a change occurs to:

(i) the particulars set out in the person’s statement of affairs in relation to the bankruptcy; or

(ii) the person’s name; or

(iii) the address of the person’s principal place of residence.

Note: Section 139R of the Act provides that any liability of a bankrupt under section 139P or 139Q of the Act is not affected by the bankrupt’s discharge from bankruptcy after the making of the assessment that gave rise to the liability.

(2) The person must:

(a) give the trustee written notice of the change; and

(b) do so within 2 business days after the change occurs.

(3) A person commits an offence if:

(a) the person is required to give notice in accordance with subsection (2); and

(b) the person fails to comply with the requirement.

Penalty: 10 penalty units.

(4) An offence against subsection (3) is an offence of strict liability.

(5) For the purposes of subparagraph (1)(d)(ii), a change in the name of a person is taken to occur if the person in fact assumes the use of a different name or an additional name.

Division 8—Collection of money or property by Official Receiver from person other than the bankrupt

40 Notice under section 139ZL of the Act not to refer to protected money

A notice under section 139ZL of the Act must not specify money or property that is protected, under a law of the Commonwealth or a State or Territory, from a process such as assignment, attachment, charging, execution or garnishment.

41 Notice under section 139ZL of the Act (notice of ceasing or commencing employment)

Scope

(1) This section applies if:

(a) an employer of a bankrupt receives a notice under section 139ZL of the Act in relation to the bankrupt; and

(b) after receiving the notice, the employer ceases to employ the bankrupt.

Notice by employer of cessation of employment

(2) The employer must:

(a) give the trustee of the bankrupt’s estate written notice of the day on which the bankrupt’s employment ceased; and

(b) do so within 15 business days after the day of that cessation.

Notice by bankrupt of new employment

(3) If the bankrupt commences employment with a new employer, the bankrupt must:

(a) give the trustee written notice of the following:

(i) the new employer’s name and postal address;

(ii) the address of the place where the bankrupt is employed;

(iii) the amount of the bankrupt’s average gross weekly income from the employment; and

(b) do so within 15 business days after the day on which the bankrupt commences employment with the new employer.

Offence

(4) A person commits an offence if:

(a) the person is required to give notice in accordance with subsection (2) or (3); and

(b) the person fails to comply with the requirement.

Penalty: 2 penalty units.

(5) An offence against subsection (4) is an offence of strict liability.

Division 9—Distribution of property

42 Minimum amount of dividend

For the purposes of subsection 140(9) of the Act, the amount of $50 is prescribed.

43 Manner of declaring final dividend

For the purposes of subsection 145(3) of the Act, notice must be given by serving it on each person to whom, under that subsection, it must be given.

Note: See section 102 of this instrument (service of documents).

Part 7—Discharge and annulment

44 Trustee to inform Official Receiver of return of bankrupt to Australia

(1) This section applies if:

(a) an objection to the discharge of a bankrupt has been made on a ground, or on grounds that include a ground, mentioned in paragraph 149D(1)(a) or (h) of the Act (which refer to the bankrupt being out of Australia); and

(b) the bankrupt returns to Australia; and

(c) the trustee of the bankrupt’s estate is a registered trustee; and

(d) the registered trustee becomes aware that the bankrupt has returned to Australia.

(2) Within 5 business days after the day that the registered trustee becomes aware that the bankrupt has returned to Australia, the registered trustee must give notice in writing to the Official Receiver stating:

(a) that the bankrupt has returned to Australia; and

(b) the day on which:

(i) the bankrupt returned; or

(ii) if the trustee does not know the day on which the bankrupt returned—the trustee became aware that the bankrupt had returned.

(3) A person commits an offence if:

(a) the person is required to give notice in accordance with subsection (2); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(4) An offence against subsection (3) is an offence of strict liability.

45 Grounds of objection—failure to provide complete and accurate information

For the purposes of the ground of objection mentioned in paragraph 149D(1)(d) of the Act, a bankrupt is taken to have failed to comply with a request to provide information if the bankrupt has provided information that is incomplete or inaccurate.

46 Inspector‑General to inform Official Receiver of ART decision about Inspector‑General’s decision

(1) This section applies if:

(a) a registered trustee of a bankrupt’s estate files a notice of objection under section 149B of the Act; and

(b) the Inspector‑General, under section 149K of the Act, decides to either:

(i) review the trustee’s decision to make the objection; or

(ii) refuse to review the trustee’s decision to make the objection; and

(c) an application is made to the Administrative Review Tribunal under section 149Q of the Act for the review of the decision of the Inspector‑General; and

(d) the Tribunal varies or sets aside the Inspector‑General’s decision.

(2) The Inspector‑General must:

(a) give the Official Receiver written notice of the Tribunal’s decision; and

(b) do so within 2 business days after being notified of the Tribunal’s decision.

Part 8—Trustees

Division 1—Consent to act, and appointment, as trustee of estate

47 Filing consent to act as trustee with the Official Receiver

An instrument under subsection 156A(1) of the Act in relation to a debtor must be filed with the Official Receiver:

(a) if the debtor presents a debtor’s petition to the Official Receiver—on or before the day that the debtor so presents the petition; or

(b) otherwise—before the day on which the Court makes a sequestration order against the debtor’s estate.

48 Certificate of appointment under subsection 156A(3) of the Act

If a registered trustee becomes, under subsection 156A(3) of the Act, the trustee of an estate or of joint and separate estates, the Official Receiver may give the registered trustee a certificate to that effect.

Division 2—Controlling trustees other than Official Trustee or registered trustees

49 Ineligibility of certain persons to act as controlling trustee

Prescribed circumstances

(1) For the purposes of subsection 188(2A) of the Act, a person (other than the Official Trustee or a registered trustee) is ineligible to act under Part X of the Act as a controlling trustee in relation to a debtor in any of the following circumstances:

(a) the person is or was convicted of an offence involving fraud or dishonesty at any time during the 10 year period ending on the day the debtor signs an authority under subsection 188(1) of the Act purportedly naming and authorising the person;

(b) the person is not insured against the liabilities the person may become subject to as a controlling trustee;

(c) the person is a solicitor who does not hold an Australian practising certificate (within the meaning of the Evidence Act 1995);

(d) the person is or was an insolvent under administration at any time during the 10 year period ending on the day the debtor signs an authority under subsection 188(1) of the Act purportedly naming and authorising the person;

(e) a determination under subsection (3) of this section is in force in relation to the person;

(f) both of the following apply:

(i) the person is not a full member of the Australian Restructuring Insolvency and Turnaround Association;

(ii) the person has not satisfactorily completed a course in insolvency approved by the Inspector‑General.

(2) For the purposes of subparagraph (1)(f)(ii), the Inspector‑General may approve a course in insolvency by notice published on the Australian Financial Security Authority’s website.

Determination by Inspector‑General

(3) The Inspector‑General may make a determination under this subsection in relation to a person if:

(a) the person is, or has been, a controlling trustee; and

(b) the Inspector‑General is satisfied that the person:

(i) has failed to properly exercise the powers, or carry out the duties, of a controlling trustee; or

(ii) has refused or failed to cooperate with the Inspector‑General in an inquiry or investigation under paragraph 12(1)(b) of the Act.

(4) Before making a determination under subsection (3) in relation to a person, the Inspector‑General must:

(a) give the person a written notice that:

(i) specifies the grounds on which the Inspector‑General proposes to make the determination; and

(ii) invites the person to give the Inspector‑General, within 20 business days after the day the notice is given or such longer time as is specified in the notice, a written statement showing cause why the determination should not be made; and

(b) consider the person’s written statement (if any).

(5) If the Inspector‑General makes a determination under subsection (3) in relation to a person, the Inspector‑General must give the person a written notice stating the following:

(a) that the Inspector‑General has made a determination under subsection (3) in relation to the person;

(b) the reasons for the determination.

50 Review by Tribunal of determination

Applications may be made to the Administrative Review Tribunal for review of a decision of the Inspector‑General to make a determination under subsection 49(3).

51 Official Trustee to perform duties of controlling trustee

(1) This section applies if:

(a) an authorisation by a debtor under subsection 188(1) of the Act is in force in relation to a person; and

(b) the person becomes ineligible to act as a controlling trustee under Part X of the Act because one or more of the circumstances prescribed by subsection 49(1) of this instrument apply in relation to the person.

(2) The Official Trustee must perform the duties of a controlling trustee in relation to the debtor unless and until the debtor authorises another person under subsection 188(1) of the Act.

Division 3—Registered trustee ceasing to be trustee of an estate

52 Notice of removal of trustee of estate

Court order that person cease to be trustee

(1) If, on application, the Court makes an order under subsection 90‑15(1) of Schedule 2 to the Act that a person (the old trustee) cease to be the trustee of a regulated debtor’s estate, the applicant for the order must:

(a) give a written notice to the Official Receiver that includes the following:

(i) the name of the old trustee;

(ii) the fact that the Court has ordered the old trustee to cease to be the trustee of the estate;

(iii) if the order provides for another person to be appointed as the trustee of the estate—the name of that person;

(iv) the day on which the order takes effect; and

(b) do so within 2 business days after the day the order is made.

Inspector‑General not required to give notice

(2) However, subsection (1) does not apply if the applicant is the Inspector‑General.

Removal of trustee by creditors

(3) If the creditors of a regulated debtor, by resolution at a meeting, remove the trustee (the old trustee) of the regulated debtor’s estate under paragraph 90‑35(1)(a) of Schedule 2 to the Act, the person appointed by the creditors under paragraph 90‑35(1)(b) of that Schedule as trustee of the estate must:

(a) give a written notice to the Official Receiver that includes the following:

(i) the name of the old trustee;

(ii) the fact that the creditors have removed the old trustee;

(iii) the day on which the removal takes effect; and

(b) do so within 2 business days after the day of the person’s appointment.

Official Trustee not required to give notice

(4) However, subsection (3) does not apply if the person appointed is the Official Trustee.

Offence

(5) A person commits an offence if:

(a) the person is required to give notice in accordance with subsection (1) or (3); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(6) An offence against subsection (5) is an offence of strict liability.

53 Notice of finalisation of administration

(1) If the trustee of a regulated debtor’s estate (other than the Official Trustee) finalises the administration of the debtor’s estate, the trustee must:

(a) give the Official Receiver written notice of the finalisation; and

(b) do so within 5 business days after the day of the finalisation.

Offence

(2) A person commits an offence if:

(a) the person is required to give notice in accordance with subsection (1); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(3) An offence against subsection (2) is an offence of strict liability.

Part 9—Debt agreements

54 Prescribed information to be supplied to debtor

(1) For the purposes of paragraph 185C(2D)(b) of the Act, the following information is prescribed:

(a) information about alternatives to entering into a debt agreement;

(b) information about the consequences of making a debt agreement proposal;

(c) information about sources of financial advice and guidance to persons facing or contemplating entering into a debt agreement;

(d) a statement that it is an act of bankruptcy for a debtor to give a debt agreement proposal to the Official Receiver.

(2) The information must be factual and objective.

55 Presentation of debt agreement proposal

(1) This section applies if a debtor intends to give the Official Receiver a debt agreement proposal under subsection 185C(1) of the Act and the debtor is:

(a) unable to read the relevant material, because the debtor:

(i) is blind or has low vision; or

(ii) is illiterate or partially literate; or

(iii) is insufficiently familiar with the English language; or

(b) unable to sign the debt agreement proposal because of a physical incapacity.

(2) The debt agreement proposal may be signed on behalf of the debtor by another person, who must also sign a statement:

(a) if subparagraph (1)(a)(i) or (ii) applies—that the person has read the relevant material to the debtor; or

(b) if subparagraph (1)(a)(iii) applies—that the person has interpreted the relevant material to the debtor in a language with which the person and the debtor are familiar; or

(c) if paragraph (1)(b) applies—that the person believes that the debtor has read and understood the relevant material.

(3) In this section:

relevant material means the debt agreement proposal and the information prescribed by section 54.

56 Qualifications for approval of application to be registered as debt agreement administrator

For the purposes of paragraph 186C(2)(e) of the Act, the prescribed qualifications are any of the following:

(a) any of the following awarded by a registered provider (within the meaning of the Education Services for Overseas Students Act 2000):

(i) a Certificate IV in Financial Services (Accounting) awarded for study starting between 10 July 2004 and 23 November 2010;

(ii) a Certificate IV in Accounting awarded for study starting between 24 November 2010 and 12 February 2018;

(iii) a Certificate IV in Accounting and Bookkeeping awarded for study starting on or after 13 February 2018;

(b) a degree, diploma or similar qualification for which the following conditions are satisfied:

(i) it is of a level equivalent to or higher than a qualification mentioned in paragraph (a);

(ii) the study for it included the same or similar subject matter as the study for a qualification mentioned in paragraph (a);

(iii) it was awarded by an Australian tertiary education institution;

(c) a degree, diploma or similar qualification awarded by a foreign tertiary education institution and for which the Inspector‑General is satisfied the following conditions are satisfied:

(i) it is of a level equivalent to or higher than a qualification mentioned in paragraph (a);

(ii) the study for it included the same or similar subject matter as the study for a qualification mentioned in paragraph (a);

(d) membership of either of the following bodies:

(i) Chartered Accountants Australia and New Zealand;

(ii) CPA Australia Ltd.

57 Prescribed amount of owed notified estate charges preventing renewal of registration as debt agreement administrator

For the purposes of paragraphs 186C(3)(d) and (5)(d) of the Act, the prescribed amount of notified estate charges is $500.

Part 10—Personal insolvency agreements

58 Modifications of Part X of the Act—joint debtors

For the purposes of section 187A of the Act, a provision of Part X of the Act specified in Part 1 of Schedule 3 to this instrument is modified in accordance with Part 1 of Schedule 3 to this instrument in relation to its application, in accordance with that section of the Act, to joint debtors, whether partners or not.

59 Information to be given to debtor about personal insolvency agreements

Prescribed information

(1) For the purposes of subsections 188(2AA) and (2AB) of the Act, the following information is prescribed:

(a) information about the consequences of entering into a personal insolvency agreement;

(b) information about sources of financial advice and guidance to persons facing or contemplating entering into a personal insolvency agreement;

(c) information about whether a personal insolvency agreement may be administered by a registered trustee or the Official Trustee;

(d) a statement that it is an act of bankruptcy if any of the things mentioned in paragraphs 40(1)(i) to (m) of the Act happen in relation to a debtor;

(e) information about the processes under Part X of the Act;

(f) information about a debtor’s rights and responsibilities under Part X of the Act, including a debtor’s obligation to disclose all related entities;

(g) information about a controlling trustee’s obligation to disclose the controlling trustee’s relationship (if any) with a debtor.

(2) The information must be factual and objective.

Acknowledgement that prescribed information has been received and read

(3) A registered trustee or a solicitor authorised by a debtor, under subsection 188(1) of the Act, to take control of the debtor’s property must not consent to exercise the powers given by the authority unless the debtor has given the registered trustee or the solicitor, as the case may be, a signed acknowledgement that the debtor has received and read the prescribed information.

(4) If the Official Trustee is authorised by a debtor, under subsection 188(1) of the Act, to take control of the debtor’s property, the Official Receiver must not give the debtor a written approval under paragraph 188(2)(aa) of the Act unless the debtor has given the Official Trustee a signed acknowledgement that the debtor has received and read the prescribed information.

60 Signing authority by another person on behalf of debtor

(1) This section applies if a debtor intends to sign an authority under subsection 188(1) of the Act and the debtor is:

(a) unable to read the relevant material, because the debtor:

(i) is blind or has low vision; or

(ii) is illiterate or partially literate; or

(iii) is insufficiently familiar with the English language; or

(b) unable to sign the authority or an acknowledgement under subsection 59(3) of this instrument relating to the authority because of a physical incapacity.

(2) The authority and the acknowledgement may be signed by another person, who must sign a statement:

(a) if subparagraph (1)(a)(i) or (ii) applies—that the person has read the relevant material to the debtor; or

(b) if subparagraph (1)(a)(iii) applies—that the person has interpreted the relevant material to the debtor in a language with which the person and debtor are familiar; or

(c) if paragraph (1)(b) applies—that the person believes that the debtor has read and understood the relevant material.

(3) In this section:

relevant material means the authority, the information prescribed by section 59 and the acknowledgement under subsection 59(3) relating to the authority.

61 Documents under section 188 of the Act

Scope

(1) This section applies if:

(a) a debtor, under section 188 of the Act, signs an authority that names and authorises a person; and

(b) the person is a registered trustee or a solicitor; and

(c) the person consents to exercise the powers given by the authority.

Consent of registered trustee or solicitor

(2) The person must:

(a) sign a consent in accordance with the approved form; and

(b) within 2 business days after signing the consent, give a copy of the signed consent to the Official Receiver.

Proposal for dealing with debtor’s affairs

(3) The person must, at the same time as calling a meeting of the debtor’s creditors, give a copy of the proposal for dealing with the debtor’s affairs under Part X of the Act to:

(a) the Official Receiver; and

(b) each creditor of the debtor of whom the person is aware.

Note 1: An authority signed by a debtor under section 188 of the Act is not effective for the purposes of Part X of the Act unless, before the person authorised consents to exercise the powers given by the authority, the debtor gives to the person authorised:

(a) a statement of the debtor’s affairs; and

(b) a proposal for dealing with those affairs under Part X of the Act (see subsection 188(2C) of the Act).

Note 2: Under subsection 188(5) of the Act, a registered trustee or solicitor who consents to exercise the powers given by an authority must also give a copy of the authority and the debtor’s statement of affairs to the Official Receiver.

62 Controlling trustee to give Official Receiver copy of special resolution and certain particulars

Scope

(1) This section applies if:

(a) under an authority under section 188 of the Act, a controlling trustee calls a meeting of a debtor’s creditors; and

(b) a special resolution is passed at the meeting under subsection 204(1) of the Act.

Information to be given to Official Receiver

(2) The controlling trustee must:

(a) give to the Official Receiver:

(i) a copy of the resolution; and

(ii) written notice of the particulars specified in subsection (3); and

(b) do so within 5 business days after the day the resolution is passed.

(3) The following particulars are specified:

(a) the date of the resolution;

(b) the debtor’s full name and alias (if any);

(c) the debtor’s address;

(d) the debtor’s occupation (if any);

(e) if the resolution requires the debtor to execute a personal insolvency agreement—the name of each person nominated under subsection 204(3) of the Act to be a trustee of the agreement.

Official Trustee not required to give information

(4) However, subsection (2) does not apply if the controlling trustee is the Official Trustee.

Offence

(5) A person commits an offence if:

(a) the person is required to give notice, and a copy of a resolution, in accordance with subsection (2); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(6) An offence against subsection (5) is an offence of strict liability.

63 Modifications of Part VIII of the Act—controlling trustees and trustees of personal insolvency agreements

For the purposes of section 210 of the Act, a provision of Part VIII of the Act specified in Part 2 of Schedule 3 to this instrument is modified in accordance with Part 2 of Schedule 3 to this instrument in relation to its application, in accordance with that section, to the controlling trustee in relation to a debtor.

64 Modifications of Division 1 of Part V of the Act—debtors whose property is subject to control under Division 2 of Part X of the Act

For the purposes of subsection 211(1) of the Act, a provision in Division 1 of Part V of the Act specified in Part 3 of Schedule 3 to this instrument is modified in accordance with Part 3 of Schedule 3 to this instrument in relation to its application, in accordance with that subsection, to a debtor whose property is subject to control under Division 2 of Part X of the Act.

65 Notification of personal insolvency agreement

For the purposes of subsection 218(3) of the Act, a notification under paragraph 218(1)(a) of the Act must be in writing.

66 Information to be given to Official Receiver in relation to certain sequestration orders

(1) If the Court makes a sequestration order under subsection 221(1), 222(10) or 222C(5) of the Act, the applicant for the order must:

(a) give a copy of the order to the Official Receiver; and

(b) do so within 2 business days after the order is made.

Official Trustee and Inspector‑General not required to give copies

(2) However, subsection (1) does not apply if the applicant is the Official Trustee or the Inspector‑General.

Offence

(3) A person commits an offence if:

(a) the person is required to give a copy of an order to the Official Receiver in accordance with subsection (1); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(4) An offence against subsection (3) is an offence of strict liability.

67 Information to be given to Official Receiver in relation to orders terminating or setting aside a personal insolvency agreement

(1) If the Court makes an order:

(a) under subsection 222(1), (2) or (5) of the Act, setting aside a personal insolvency agreement; or

(b) under subsection 222C(1) of the Act, terminating a personal insolvency agreement;

the applicant for the order must:

(c) give a copy of the order to the Official Receiver; and

(d) do so within 2 business days after the order is made.

Persons not required to give copies

(2) However, subsection (1) does not apply if the applicant is:

(a) the Official Trustee; or

(b) the Inspector‑General; or

(c) a registered trustee.

Note: If the Court makes an order setting aside or terminating a personal insolvency agreement and a registered trustee was the trustee of the agreement, the registered trustee must give written notice of the order to the Official Receiver (see subsection 224A(4) of the Act).

Offence

(3) A person commits an offence if:

(a) the person is required to give a copy of an order to the Official Receiver in accordance with subsection (1); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(4) An offence against subsection (3) is an offence of strict liability.

68 Termination of personal insolvency agreement by trustee

(1) If a personal insolvency agreement is terminated in accordance with section 222A of the Act, the trustee of the agreement must:

(a) give written notice of the termination to the Official Receiver; and

(b) do so within 2 business days after the termination takes effect.

Note: Before the termination takes effect, the trustee must give notice of the proposed termination to all the creditors who are entitled to receive notice of a meeting of creditors (see subsection 222A(2) of the Act).

Official Trustee not required to give copies

(2) However, subsection (1) does not apply if the trustee of the agreement is the Official Trustee.

Offence

(3) A person commits an offence if:

(a) the person is required to give notice in accordance with subsection (1); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(4) An offence against subsection (3) is an offence of strict liability.

69 Modifications of Parts V and VI of the Act—personal insolvency agreements

(1) For the purposes of subsection 231(1) of the Act, a provision specified in Part 4 of Schedule 3 to this instrument is modified in accordance with that Part in relation to its application, in accordance with that subsection, to a debtor who has executed a personal insolvency agreement.

(2) For the purposes of subsection 231(3) of the Act, a provision specified in Part 5 of Schedule 3 to this instrument is modified in accordance with that Part in relation to its application, in accordance with that subsection, to a personal insolvency agreement.

70 Certificate relating to realisation of divisible property and non‑availability of dividend

Certificate to be given to debtor

(1) If the trustee of a personal insolvency agreement in relation to a debtor is satisfied that:

(a) the divisible property of the debtor has, so far as practicable, been realised; and

(b) no dividend is payable to the creditors;

the trustee must give the debtor a certificate signed by the trustee to that effect.

(2) The trustee must give the certificate to the debtor within 5 business days after becoming so satisfied.

(3) In any proceeding, a certificate signed by the trustee under subsection (1):

(a) is prima facie evidence of the matters stated in it; and

(b) may be tendered in evidence without further proof.

Copy of certificate to be given to Official Receiver

(4) If the trustee gives a certificate to the debtor under subsection 232(1) of the Act or subsection (1) of this section, the trustee must:

(a) give a copy of the certificate to the Official Receiver; and

(b) do so within 5 business days after giving the certificate.

Official Trustee not required to give copy

(5) However, subsection (4) does not apply if the trustee is the Official Trustee.

Offence

(6) A person commits an offence if:

(a) the person is required to give a copy of a certificate to the Official Receiver in accordance with subsection (4); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(7) An offence against subsection (6) is an offence of strict liability.

Part 11—Administration of estates of deceased persons in bankruptcy

71 Modifications of the Act—administration of estates of deceased persons

For the purposes of subsections 248(1) and (3) of the Act, a provision specified in Schedule 4 to this instrument is modified in accordance with that Schedule in relation to proceedings under Part XI of the Act and the administration of estates under that Part.

Part 12—Unclaimed dividends or money

72 Statement where money paid to the Commonwealth

Statement about payment to Commonwealth of unclaimed money

(1) If a trustee (within the meaning of section 254 of the Act) pays money to the Commonwealth under subsection 254(2) of the Act, the trustee must:

(a) give to the Official Receiver a statement in the approved form setting out the name and address of the following:

(i) the trustee;

(ii) unless subparagraph (iii) applies—the relevant bankrupt or debtor;

(iii) if the trustee is a trustee of the estate of a deceased person—the deceased person;

(iv) each person who, so far as the trustee is aware, is entitled to the money or any part of it; and

(b) do so at the time of payment.

Note: Payments to the Commonwealth under subsection 254(2) of the Act are made to the Official Receiver on behalf of the Commonwealth.

Official Trustee not required to give statement about payment to Commonwealth of unclaimed money

(2) However, subsection (1) does not apply if the trustee is the Official Trustee.

Statement about payment to Commonwealth following withdrawal of creditor’s petition

(3) If a registered trustee pays money to the Commonwealth under subsection 254(2A) of the Act, the registered trustee must:

(a) give to the Official Receiver a statement in the approved form setting out the name and address of:

(i) the payer; and

(ii) each person who, so far as the registered trustee is aware, is entitled to the money or any part of it; and

(b) do so at the time of payment.

Note: Payments to the Commonwealth under subsection 254(2A) of the Act are made to the Official Receiver on behalf of the Commonwealth.

Offence

(4) A person commits an offence if:

(a) the person is required to give a statement to the Official Receiver under subsection (1) or (3); and

(b) the person fails to comply with the requirement.

Penalty: 1 penalty unit.

(5) An offence against subsection (4) is an offence of strict liability.

Part 13—National Personal Insolvency Index

Division 1—General

73 Establishment and maintenance of the National Personal Insolvency Index

(1) For the purposes of the definition of National Personal Insolvency Index in subsection 5(1) of the Act, an electronic index to be known as the National Personal Insolvency Index is established.

(2) The Inspector‑General has responsibility for the operation of the Index.

(3) The Inspector‑General has control of access to the Index.

(4) The Official Receiver is to maintain the Index on behalf of the Inspector‑General.

74 Information in the Index

Division 2 of this Part (information to be entered in the Index) has effect subject to Division 3 of this Part (information not to be entered in the Index and information to be removed from the Index).

Division 2—Information to be entered in the Index

75 Documents that must be given to Official Receiver