AASB Standard | AASB 2021-1 |

This Standard is available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

Website: www.aasb.gov.au

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

© Commonwealth of Australia 2021

This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission. Requests and enquiries concerning reproduction and rights should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

ISSN 1036-4803

PREFACE

ACCOUNTING STANDARD

AASB 2021-1 Amendments to Australian Accounting Standards – Transition to Tier 2: Simplified Disclosures for Not-for-Profit Entities

from paragraph

APPLICATION 2

AMENDMENTS TO AASB 1053 6

AMENDMENTS TO AASB 1060 8

COMMENCEMENT OF THE LEGISLATIVE INSTRUMENT 9

BASIS FOR CONCLUSIONS

Australian Accounting Standard AASB 2021-1 Amendments to Australian Accounting Standards – Transition to Tier 2: Simplified Disclosures for Not-for-Profit Entities is set out in paragraphs 1 – 9. All the paragraphs have equal authority.

This Standard makes amendments to AASB 1053 Application of Tiers of Australian Accounting Standards (June 2010) and AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities (March 2020).

Main requirements

This Standard amends AASB 1060 to provide not-for-profit entities with optional relief from presenting comparative information in the notes to the financial statements where the entity did not disclose the comparable information in its most recent previous general purpose financial statements. This relief is available for not-for-profit entities transitioning from either Tier 1: Australian Accounting Standards or Tier 2: Australian Accounting Standards – Reduced Disclosure Requirements to Tier 2: Australian Accounting Standards – Simplified Disclosures for a reporting period prior to the entity’s mandatory application of AASB 1060.

Amendments to AASB 1053 highlight that the relief set out in Appendix E of AASB 1053 is available only to for-profit private sector entities.

Application date

This Standard applies to annual periods beginning on or after 1 July 2021. Earlier application is permitted, provided that AASB 1060 is also applied to the same period.

The Australian Accounting Standards Board makes Accounting Standard AASB 2021-1 Amendments to Australian Accounting Standards – Transition to Tier 2: Simplified Disclosures for Not-for-Profit Entities under section 334 of the Corporations Act 2001.

| Keith Kendall |

Dated 29 March 2021 | Chair – AASB |

Amendments to Australian Accounting Standards – Transition to Tier 2: Simplified Disclosures for Not-for-Profit Entities

1 This Standard amends AASB 1053 Application of Tiers of Australian Accounting Standards (June 2010) and AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities (March 2020) principally to provide not-for-profit entities with optional relief in certain circumstances from presenting comparative information in the notes to the financial statements when transitioning from either Tier 1: Australian Accounting Standards or Tier 2: Australian Accounting Standards – Reduced Disclosure Requirements to Tier 2: Australian Accounting Standards – Simplified Disclosures.

2 The amendments set out in this Standard apply to entities and financial statements in accordance with the application of the other Standards set out in AASB 1057 Application of Australian Accounting Standards.

3 This Standard applies to annual periods beginning on or after 1 July 2021.

4 This Standard may be applied to annual periods beginning before 1 July 2021 provided that entities apply AASB 1060 to the same period. When an entity applies this Standard to such an annual period, it shall disclose that fact.

5 This Standard uses underlining, striking out and other typographical material to identify some of the amendments to a Standard, in order to make the amendments more understandable. However, the amendments made by this Standard do not include that underlining, striking out or other typographical material. Amended paragraphs are shown with deleted text struck through and new text underlined.

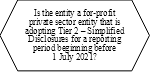

6 In Appendix C accompanying AASB 1053, Chart 1: First-time Adoption of Tier 1 or Tier 2 Reporting Requirements (paragraphs 18–18D) is replaced with the following chart.

Chart 1: First-time Adoption of Tier 1 or Tier 2 Reporting Requirements (paragraphs 18−18D)

![]()

![]()

![]()

7 In Appendix E, a heading is added immediately before paragraph E1.

8 In Appendix B, paragraph B1 is amended.

B1 An entity shall apply this Standard for annual reporting periods beginning on or after 1 July 2021. Earlier application is permitted. If an entity applies this Standard earlier:

(a) it shall disclose that fact; and

(b) if the entity is a for-profit private sector entity – it may elect to apply the short-term exemptions in AASB 1053 Application of Tiers of Australian Accounting Standards Appendix E, where applicable; or

(c) if the entity is a not-for-profit entity – notwithstanding paragraph 20, it may elect not to present comparative information in the notes to the financial statements if the entity did not disclose the comparable information in its most recent previous general purpose financial statements.

9 For legal purposes, this legislative instrument commences on 30 June 2021.

Basis for Conclusions

This Basis for Conclusions accompanies, but is not part of, AASB 2021-1 Amendments to Australian Accounting Standards – Transition to Tier 2: Simplified Disclosures for Not-for-Profit Entities.

Introduction

BC1 This Basis for Conclusions summarises the Australian Accounting Standards Board’s considerations in reaching the conclusions in this Standard. It sets out the reasons why the Board developed the Standard, the approach taken to developing the Standard and the bases for key decisions made. In making decisions, individual Board members gave greater weight to some factors than to others.

Reasons for issuing this Standard

BC2 The Board noted that not-for-profit (NFP) entities transitioning from either Tier 1: Australian Accounting Standards or Tier 2: Australian Accounting Standards – Reduced Disclosure Requirements (RDR) and adopting Tier 2: Australian Accounting Standards – Simplified Disclosures (SD) early (ie for reporting periods beginning before 1 July 2021) would not be able to access the transitional relief that is available to for-profit private sector entities. For-profit private sector entities that transition between the Tier 2 frameworks by adopting Tier 2 SD early are provided optional relief from presenting comparative information in the notes to the financial statements if the entity did not previously disclose the comparable information in its most recent previous financial statements. This relief is set out in paragraph E4 of AASB 1053 Application of Tiers of Australian Accounting Standards. For-profit private sector entities that transition from Tier 1 to Tier 2 SD early are also provided with this same optional disclosure relief.

BC3 To address this difference, the Board decided to make a narrow-scope amendment to AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities to provide NFP entities with the same optional transition relief as for-profit entities when transitioning early from Tier 1 or Tier 2 RDR to Tier 2 SD.

Issue of Exposure Draft ED 306

BC4 The Board’s proposals with respect to the transition relief finalised in this Standard were exposed for public comment in December 2020 as part of Exposure Draft ED 306 Transition Between Tier 2 Frameworks for Not-for-Profit Entities.

BC5 The significant issues considered by the Board in developing ED 306 are addressed in the following sections.

Scope

Location of amendments

Other amendments

BC10 The Board also proposed some editorial improvements to AASB 1053 to highlight that the relief set out in Appendix E of AASB 1053 applies only to for-profit private sector entities.

Finalisation of ED 306 proposals

BC11 Following the consultation period, and after considering the comments received, the Board decided to proceed with issuing this Standard, with minimal changes from the proposals in ED 306.

Feedback from respondents on ED 306

BC12 The Board received six formal comment letters on ED 306. The feedback received indicated that, in general, all respondents were supportive of the proposals. However, some respondents suggested that:

(b) consequently, AASB 1060 may not be the best place for the proposed amendments, given their support for additional transitional relief for NFP entities.

BC13 The Board considered this feedback and decided:

(a) to extend the relief from presenting comparative information for those disclosures not previously made to also include transition from Tier 1 to Tier 2 SD. This was because both Tier 1 and Tier 2 SD are prepared on the same recognition and measurement basis and there would be very few, if any, disclosures for which comparative information was not presented. Extending the relief would therefore have a limited impact on comparability and would provide consistent optional relief for NFP entities transitioning between types of general purpose financial statements;

(b) not to provide any relief to NFP entities transitioning from SPFS at this time. As noted in paragraphs BC7 and BC8, NFP entities are not currently required to transition from SPFS. The Board did however reaffirm that it intends to consider specific transition relief for NFP entities, including those that may be required to transition from SPFS, as part of its NFP Private Sector Financial Reporting Framework project; and

(c) AASB 1060 remained the most appropriate location for these amendments. Although the optional relief in this Standard no longer applies solely to NFP entities transitioning between Tier 2 frameworks, the Board heard no compelling reasons to relocate the amendments from AASB 1060. NFP entities applying the optional relief will be transitioning to Tier 2 SD. Therefore, including the relief in the applicable Tier 2 Standard (AASB 1060) remained appropriate.

BC14 To ensure consistency between for-profit private sector entities and NFP entities, it was necessary to align the effective date of this Standard with the effective date of the equivalent relief available to for-profit private sector entities. For this reason, the Board decided that this Standard would be effective for annual periods beginning on or after 1 July 2021, with earlier application permitted, provided AASB 1060 is also applied to the same period.