1. | This section applies to a member if all of the following apply in 13 May 2021. |

| a. | The member was on one of the following. |

| | i. | A salary non-reduction period under this Division. |

| | ii. | A salary preservation provision under Part C of DFRT Determination No. 2 of 2017, Salaries. |

| b. | The member’s salary on 13 May 2021 is less than the sum of the following on 12 May 2021. |

| | i. | The member’s salary payable under the non-reduction or salary preservation provision. |

| | ii. | Service allowance payable under Division B.2 of DFRT Determination No. 11 of 2013, ADF allowances, on 12 May 2021. |

| | iii. | Uniform allowance payable to the member under Chapter 10 Part 1, 12 May 2021. |

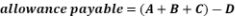

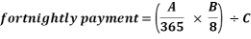

2. | The member is to be paid a fortnightly allowance calculated using the following. |

|

|

| Where: |

| A | is the member's fortnightly salary payable under the non-reduction or salary preservation provision, on 12 May 2021. |

| B | is the member's fortnightly Service allowance payable on 12 May 2021. |

| C | is the fortnightly amount of uniform allowance payable to the member on 12 May 2021. |

| D | is the fortnightly salary payable to the member from 13 May 2021. |

3. | The salary and service allowance rates under paragraph 1.b and subsection 2 are adjusted by the same proportion as any general salary increase applicable to members of the ADF. |

4. | This section ceases to apply on the day the member ceases to be eligible for salary non-reduction or salary preservation. |

1. | This section applies to salary and allowances payable under a DFRT Determination to a member on a flexible service determination. |

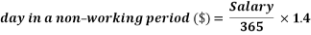

2. | For the purpose of calculating a member’s fortnightly salary, the value of a day of a nonworking period is the following. |

| a. | For the first 4 days of a nonworking period in a fortnight — $0.00. |

| b. | For any other day of a nonworking period in a fortnight, the amount calculated using the following formula. |

|

|

| | Where: |

| | Salary means the member’s annual salary. |

| Note: Under DFRT Determination No. 2 of 2017, a member is not paid for a nonworking period. A member’s fortnightly salary is reduced by the value of the nonworking period for each day that in their nonworking period in the fortnight. |

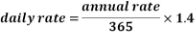

3. | For the purpose of a DFRT allowance, the value of a day of a nonworking period is one of the following. |

| a. | For the first 4 days of a nonworking period in a fortnight — $0.00. |

| b. | For every other day of a nonworking period in a fortnight, the amount calculated using the following formula. |

|

|

| | Where: |

| | Allowance means the annual rate of a DFRT allowance payable to a member. |

| Note: Under DFRT Determination No. 11 of 2013, a member is not paid for a nonworking period. A member’s fortnightly rate of the allowance is reduced by the value of the nonworking period for each day in their nonworking period in the fortnight. |

5 | Subsection 3.2.7A (Administration of salary and allowances – member on a flexible service determination) |

| Omit the section, substitute: |

1. | This section applies to an allowance under this Determination that has an annual rate and is payable to a member on a flexible service determination other than the following. |

| a. | ADF District allowance under Chapter 4 Part 4 Division 1 and Division 2. |

| b. | Scherger allowance under Chapter 4 Part 4 Division 4. |

| c. | Antarctic allowance under Chapter 4 Part 4 Division 6. |

| d. | Common duties allowance (Antarctic) under Chapter 4 Part 4 Division 6. |

| e. | Antarctic parity allowance under Chapter 4 Part 4 Division 8. |

2. | If the member is eligible for the payment of an allowance, the allowance is paid for all of the following days. |

| a. | Each full day of duty in a fortnight in the member’s flexible service determination. |

| b. | Each part day of duty in the fortnight that adds up to 8 hours when combined with another part day of duty in the fortnight. |

3. | The daily rate of an annual rate of an allowance under this Determination calculated using the following formula. |

|

|

4. | The maximum fortnightly rate payable to a member must not exceed the fortnightly rate of a member not on a flexible service determination. |

6 | Subsection 3.2.25.2 (Salary – member undergoing recategorisation training) |

| Omit the subsection, substitute: |

2. | The member is to be paid the relevant of the following amounts for the duration of the training. |

| a. | For a member of the Permanent Forces or a member of the Reserves on continuous full-time service — the rate of salary for the rank, pay grade or specialist level and increment that they held immediately before they began training. |

| b. | For a member on Reserve service — the daily rate of salary for the rank, pay grade or specialist level and increment that they held immediately before they began training. |

| c. | For a member of the Reserves who transfers to the Permanent Forces or undertakes a period of continuous full-time service for the period of their training — the rate of salary for the rank, pay grade or specialist level and increment that they would have held if they were on continuous full-time service immediately before they began training. |

7 | Section 4.4.38 (Definitions) |

| Omit from the definition of ADF amount “, service allowance”. |

8 | Section 4.8.11 (Rate of entitlement) |

| Omit the section, substitute: |

| | | |

1. | A member is eligible for an allowance payable at the end of each 3-month period if all of the following are met. |

| a. | The member’s refresher training takes place at a civilian hospital. |

| b. | The member’s salary is less than the salary the member would have received if they were paid by the hospital. |

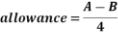

2. | The allowance payable under subsection 1 is calculated using the following formula. |

|

|

| Where: |

| A | The annual salary the member would have received if they were paid by the hospital. |

| B | The member’s annual salary. |

10 | Subsection 4.9.7.2 (Disposable income for ADF members), Note 1 |

| Omit the note. |

11 | Section 4.9.18 (Definitions) |

| Omit the section. |

12 | Subsection 4.9.20.1 (Payments for periods of isolation associated with military service), Note 2 |

| Omit “and Reserve allowance”. |

13 | Subsection 4.9.20.2 (Payments for periods of isolation associated with military service) |

| Omit “and Reserve allowance”. |

14 | Subsection 4.9.20.3 (Payments for periods of isolation associated with military service) |

| Omit “and Reserve allowance”. |

15 | Subsection 4.9.21.2 (Payment following a Defence activity) |

| Omit “and Reserve allowance”. |

16 | Subsection 4.9.21.3 (Payment following a Defence activity) |

| Omit “and Reserve allowance”. |

17 | Subsection 4.9.22.2 (Payment for an inability work a pattern of Reserve service) |

| Omit “and Reserve allowance”. |

18 | Subsection 4.9.23.2 (Payment for COVID-19) |

| Omit “and Reserve allowance”. |

19 | Subsection 5.3.9.1 (Payment of salary and allowances on a medical absence), Exception |

| Omit the exception. |

20 | Subsection 5.4.23.2 (Approval to purchase recreation leave) |

| Omit “Service allowance”. |

21 | Subsection 5.4.24.2 (Payment) |

| Omit the subsection, substitute: |

2. | The member’s fortnightly payment is calculated as follows. |

|

|

| Where: |

| A | is the member’s annual rate of salary. |

| B | is the number of hours of leave the member is purchasing. |

| C | is the number of pay periods over which the member has elected to make the payments. |

22 | Subsection 5.4.24.3 (Payment) |

| Omit the subsection. |

23 | Paragraph 7.4.38.c (Basis) |

| Omit “ship’s galley”, substitute “ship’s or submarine’s galley”. |

24 | Section 7.4.41 (Conditions for member posted to a seagoing submarine) |

| Omit the section. |

25 | Section 7.4.49 (Laundry allowance for seagoing member in temporary accommodation ashore) |

| Omit the section. |

26 | Paragraph 7.9.5.2.b (Casual meal charges) |

| Omit the paragraph, substitute: |

| b. | They are a member with dependants (unaccompanied) and any of the following apply. |

| | i. | The member is not receiving food allowance. |

| | ii. | The member is not on a flexible service determination while they are on a nonworking period. |

27 | Paragraph 7.9.5.2.c (Casual meal charges), exceptions |

| After exception 2, insert: |

| 3. | A member without dependants who is posted to a seagoing submarine. |

28 | Paragraph 7.9.6.1.b (Fortnightly meal charges), exceptions |

| After exception 2, insert: |

| 3. | A member without dependants who is posted to a seagoing submarine. |

29 | Section 7.9.12 (Eligibility and rate of submarine food allowance for member posted to a seagoing submarine) |

| Omit the section. |

30 | Chapter 10 Part 1 (Uniform allowance) |

| Omit the Part. |

31 | Subsection 10.5.3.3 (Eligibility for Service police investigator plain clothes allowance), note |

| Omit the note. |

32 | Subsection 10.5.3.3 (Eligibility for Service police investigator plain clothes allowance), see note |

| Omit the see note. |

| | | | |