Superannuation Amendment (PSS Trust Deed) Instrument 2021 (No. 2)

I, Simon Birmingham, Minister for Finance, make the following instrument.

Dated 5 December 2021

Simon Birmingham

Minister for Finance

Superannuation Amendment (PSS Trust Deed) Instrument 2021 (No. 2)

I, Simon Birmingham, Minister for Finance, make the following instrument.

Dated 5 December 2021

Simon Birmingham

Minister for Finance

This instrument is the Superannuation Amendment (PSS Trust Deed) Instrument 2021 (No. 2).

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 4 and anything in this instrument not elsewhere covered by this table | The day after this instrument is registered on the Federal Register of Legislation. |

|

2. Schedule 1 | The day after this instrument is registered on the Federal Register of Legislation. |

|

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

This instrument is made under section 5 of the Superannuation Act 1990.

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendment of the PSS Trust Deed

1 Rule 3.5.1

Repeal the table, substitute:

Average Salary Factors | ||

Cessation otherwise than on involuntary retirement | Cessation on involuntary retirement | |

NOTE: The factors defined for the case of not ceasing on involuntary retirement are used to calculate average salary on cessation on involuntary retirement, if the date of cessation is an anniversary of the regular member’s birth, or is treated as such under Rule 3.5.4. | ||

Three or more anniversaries of birth in period of membership (see also Rule 3.5.5) | ||

X is 0. | X is the amount calculated by the following formula:

where: D is 1 plus the number of days between the date of the regular member’s cessation on involuntary retirement and the date of the anniversary of his/her birth immediately preceding the date of cessation; and O is the regular member’s salary for average salary purposes (see Rule 3.5.2) on the date of his/her cessation on involuntary retirement; and P is the regular member’s salary for average salary purposes (see Rule 3.5.2) on the anniversary of his/her birth immediately preceding the anniversary in B2 below. | |

B1 is | B1 is | |

B2 is | ||

B3 is | B3 is 0.

| |

E is 0. | ||

n is 3. | ||

Two anniversaries of birth in period of membership (see also Rule 3.5.5) | ||

X is 0. | X is the amount calculated by the following formula:

where: D is 1 plus the number of days between the date of the regular member’s cessation on involuntary retirement and the date of the anniversary of his/her birth immediately preceding the date of cessation; and O is the regular member’s salary for average salary purposes (see Rule 3.5.2) on the date of his/her cessation on involuntary retirement; and P is the regular member’s salary for average salary purposes (see Rule 3.5.2) on his/her first day of membership. | |

B1 is | B1 is | |

B2 is | ||

B3 is 0. | ||

E is the regular member’s salary for average salary purposes (see Rule 3.5.2) on his/her first day of membership. | E is 0. | |

n is 3. | ||

One anniversary of birth in period of membership (see also Rule 3.5.5) | ||

X is 0. | X is the amount calculated by the following formula:

where: D is 1 plus the number of days between the date of the regular member’s cessation on involuntary retirement and the date of the anniversary of his/her birth immediately preceding the date of cessation; and O is the regular member’s salary for average salary purposes (see Rule 3.5.2) on the date of his/her cessation on involuntary retirement; and P is the regular member’s salary for average salary purposes (see Rule 3.5.2) on his/her first day of membership. | |

B1 is | B1 is | |

B2 is 0. | ||

B3 is 0. | ||

E is the regular member’s salary for average salary purposes (see Rule 3.5.2) on his/her first day of membership. | E is 0. | |

n is 2. | ||

No anniversaries of birth in period of membership (see also Rule 3.5.5) | ||

X is 0. | X is the amount calculated by the following formula:

where: D is 1 plus the number of days between the date of the regular member’s cessation on involuntary retirement and the date of his/her first day of membership; and O is the regular member’s salary for average salary purposes (see Rule 3.5.2) on the date of his/her cessation on involuntary retirement; and P is the regular member’s salary for average salary purposes (see Rule 3.5.2) on his/her first day of membership. | |

B1 is 0. | ||

B2 is 0. | ||

B3 is 0. | ||

E is the regular member’s salary for average salary purposes (see Rule 3.5.2) on his/her first day of membership. | E is 0. | |

n is 1. | ||

2 Rule 5.2.1

Omit “under this Division”.

3 Rule 5.2.1

Repeal the table, substitute:

Quick Guide to the Components of a Benefit Accrual Multiple | |||

| Possible Components | Results from | See |

| On‑going Multiple | Paying fortnightly contributions | Rule 5.2.2 |

| Additional Cover | An amount received from a life office in respect of a policy for extra death and invalidity cover | Rule 5.2.10 |

| Preserved Multiple | A preserved benefit from a previous period of PSS membership | Rule 5.2.12 |

| Restoration Multiple | A former invalidity pensioner again becoming a member | Rule 5.2.14 |

| Excess Contribution Multiple | Paying fortnightly contributions above the maximum average rate that attract employer benefits | Rule 5.2.16 |

| Unfunded Transfer | An amount transferred on entry to the PSS scheme that is exclusively productivity benefit | Rule 5.2.18 |

| Membership Transfer Multiple | Combining benefits from previously concurrent periods of membership | Rule 5.2.20 |

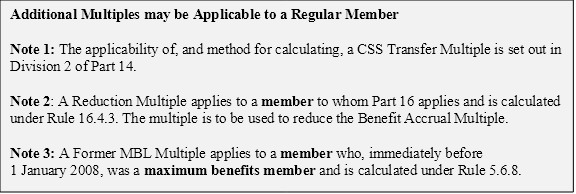

| CSS Transfer Multiple | Transferring entitlements from the CSS scheme | Division 2 of Part 14 |

| Non‑Cash Transfer Multiple | An amount that would otherwise have been payable to an approved superannuation scheme in respect of a person who had transferred to that scheme from the PSS scheme or the CSS scheme | Rule 5.2.23 |

| Reduction Multiple | The application of a splitting agreement or splitting order under Part 16. | Rule 16.4.3 |

| Former MBL Multiple | A member who was a maximum benefits member immediately before 1 January 2008 | Rule 5.6.8 |

4 Rule 5.2.22

Repeal the rule, including the heading “CSS Transfer Multiple”.

5 After Rule 5.2.25

Insert:

6 Rule 5.2.26

Repeal the rule, including the heading “Reduction Multiple”.

7 Rule 5.2.27

Repeal the rule, including the heading “Former MBL Multiple”.

8 Rule 5.3.1

Omit “under this Division”.

9 Rule 5.3.1

Repeal the table, substitute:

Quick Guide to the Components of a Benefit Accrual Multiple | |||

| Possible Components | Results from | See |

| On‑going Multiple | Paying fortnightly contributions | Rule 5.3.2 |

| Additional Cover Multiple | An amount received from a life office in respect of a policy for extra death and invalidity cover | Rule 5.3.10 |

| Preserved Multiple | A preserved benefit from a previous period of PSS membership | Rule 5.3.12 |

| Restoration Multiple | A former invalidity pensioner again becoming a member | Rule 5.3.14 |

| Excess Contribution Multiple | Paying fortnightly contributions above the maximum average rate that attract employer benefits | Rule 5.3.16 |

| Unfunded Transfer Multiple | An amount transferred on entry to the PSS scheme that is exclusively productivity benefit | Rule 5.3.18 |

| Membership Transfer Multiple | Combining benefits from previously concurrent periods of membership | Rule 5.3.20 |

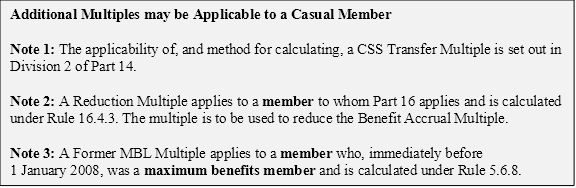

| CSS Transfer Multiple | Transferring entitlements from the CSS scheme | Division 2 of Part 14 |

| Non‑Cash Transfer Multiple | An amount that would otherwise have been payable to an approved superannuation scheme in respect of a person who had transferred to that scheme from the PSS scheme or the CSS scheme. | Rule 5.3.23 |

| Reduction Multiple | The application of a splitting agreement or splitting order under Part 16 | Rule 16.4.3 |

| Former MBL Multiple | A member who was a maximum benefits member immediately before 1 January 2008 | Rule 5.6.8 |

10 Rule 5.3.22

Repeal the rule, including the heading “CSS Transfer Multiple”.

11 After Rule 5.3.25

Insert:

12 Rule 5.3.26

Repeal the rule, including the heading “Reduction Multiple”.

13 Rule 5.3.27

Repeal the rule, including the heading “Former MBL Multiple”.

14 Rule 6.2.3

Repeal the rule, including the heading “Benefit options – certain other cases”.

15 Rule 6.2.4

Repeal the rule.

16 Rule 6.8.3

Repeal the rule, substitute:

6.8.3 The Minister and CSC may at any time terminate an agreement related to the declaration of an eligible superannuation scheme made by the Minister and the Board.

17 Rule 6.8.4

Repeal the rule, substitute:

6.8.4 The variation or termination of an agreement in relation to an eligible superannuation scheme must be notified in the annual report of CSC under section 30 of the Governance of Australian Government Superannuation Schemes Act 2011.

18 Paragraph 8.1.1(f)

Omit “; or”, substitute “.”

19 Rule 8.1.1

Repeal paragraph (g) and the note.

20 Rule 8.2.5

Repeal the rule, including the heading “Transitional benefit options for certain pre‑1 July 1996 preserved benefits members”.

21 Rule 9.2.2

Omit “This rule also applies to the calculation of an annual pension payable under Rule 6.2.4 to a member who, on retirement before 1 July 1996, was suffering from a terminal medical condition.”

22 Rule 12.2.3

Repeal the rule, including the heading “Payment of benefits to eligible roll-over fund where no instructions”.

23 After Part 17

Insert:

![]()

Division 1

17A.1.1 Where the Minister, following consultation with CSC:

(a) agrees, on behalf of the Commonwealth, that amounts which become payable to the Commonwealth under paragraph 16(1)(a), paragraph 16(4)(a) and/or subsection 16A(2) of the Superannuation Act 1990 are not due until a later time, and

(b) gives CSC written notice of this agreement, specifying a time at which amounts become due, or a mechanism for giving reasonable notice of that time,

then:

(c) those amounts accumulate with interest in the PSS Fund in accordance with a determination or determinations made by CSC as to the rate and method of allocation of interest, taking into account the after tax-earnings and/or losses from investment of the amounts, and

(d) CSC must pay the accumulated interest in relation to those amounts to the Commonwealth from the PSS Fund when those amounts become due.