Fuel Security (Minimum Stockholding Obligation) Rules 2022

I, the Hon Chris Bowen MP, Minister for Climate Change and Energy, make the following instrument.

Dated 08/11/2022

Chris Bowen

Minister for Climate Change and Energy

Contents

Part 1 —Preliminary

1 Name

2 Commencement

3 Authority

4 Definitions

Part 2 —Importing, MSO products and stock holding

5 Importing

6 MSO products

7 Pipeline stocks

8 Excluded stocks

9 Stocks within exclusive economic zone boundary

10 Jointly owned stocks

11 Entity entitled to take ownership of stocks

12 Reserved stocks

13 Refinery feedstocks—crude oil

14 Refinery feedstocks—unfinished refinery product

Part 3 —Application of MSO

15 Obligation days

16 Trigger assessment period

17 Thresholds to trigger MSO

18 Notice window and advice window

19 Notices to Australian controlling corporation

Part 4 —Designated quantity

20 Designated quantity to be specified

21 Designated quantity—general

22 Designated quantity—circumstances impacting MSO entity during trigger assessment period

23 Designated quantity—circumstances impacting MSO entity at commencement

24 Designated quantity—consistently below threshold entity

Part 5 —Temporary reduction in designated quantities

25 Applications for temporary reduction in quantity of stocks

26 Criteria for temporary reduction in quantity of stocks

27 Additional transitional reduction in quantity of stocks

Part 6 —Suspension of MSO

28 Suspension by Minister

29 Application for suspension by Secretary

30 Secretary’s decision on suspension

31 Class of entities included in a suspension

Part 7 —Notice of intention to cease all MSO activities in relation to MSO product

32 Requirements for notice of intention to cease MSO activities

Part 8 —Audit

33 Conduct of audits under section 33 or section 34 of the Act

Part 9 —MSO compliance plan

34 Operation of this Part

35 What an MSO compliance plan must contain—outline

36 What an MSO compliance plan must contain—overview of current practices

37 What an MSO compliance plan must contain—compliance pathway

38 What an MSO compliance plan must contain—data collection, reporting and record keeping

39 What an MSO compliance plan must contain—schedule of future outages

40 Provision of MSO compliance plan to Secretary

Part 10 —Assumption or division of MSO

41 Assumption or division

Part 11 —Monitoring secondary markets and assisting compliance

42 Monitoring of secondary market activity and assisting compliance

Part 12 —Publication of information

43 Information publication

Part 1—Preliminary

1 Name

This instrument is the Fuel Security (Minimum Stockholding Obligation) Rules 2022.

2 Commencement

This instrument commences on the day after it is registered.

3 Authority

This instrument is made under subsection 84(1) of the Fuel Security Act 2021.

4 Definitions

Note: A number of expressions used in this instrument are defined in the Act, including the following:

(a) Australian controlling corporation;

In this instrument:

Act means the Fuel Security Act 2021.

FQS Act means the Fuel Quality Standards Act 2000.

FSSP Rule means the Fuel Security (Fuel Security Services Payment) Rule 2021.

MSO compliance plan means a plan prepared and kept up to date for section 36 of the Act.

N10 form means the Import declaration (N10) form approved under section 71K of the Customs Act 1901, as in force from time to time.

N30 form means the Import declaration out of warehouse (Import declaration N30) form approved under section 71K of the Customs Act 1901, as in force from time to time.

NGER (Audit) Determination means the National Greenhouse and Energy Reporting (Audit) Determination 2009.

POFR Act means the Petroleum and Other Fuels Reporting Act 2017.

POFR rules means the Petroleum and Other Fuels Reporting Rules 2017.

Refinery Upgrades Program means the program established by the Industry Research and Development (Refinery Upgrades Program) Instrument 2021.

section 24 arrangement means an arrangement with effect under section 24 of the Act that MSO product is held for another entity.

trigger assessment period: see section 16.

Part 2—Importing, MSO products and stock holding

5 Importing

(1) This section prescribes acts that constitute the importation of an MSO product for paragraph (b) of the definition of “import” in section 5 of the Act.

(2) If an MSO product is imported by an entity (the first entity) under paragraph (a) of the definition of “import” on behalf of another entity (the second entity) in circumstances covered by subsection (3), the second entity has also imported the MSO product.

(3) For subsection (2), the circumstances are that:

(a) there is an arrangement agreed between each entity that MSO products are, or will be, imported on behalf of the second entity; and

(b) under the arrangement the second entity is to own the imported MSO product and is responsible for meeting relevant fees and charges relating to the importation; and

(c) the arrangement is notified in writing to the Secretary by both entities; and

(d) the Secretary has not notified the entities that arrangement is considered to be a mechanism to avoid the application of the thresholds in section 17; and

(e) the importation is covered by the arrangement.

6 MSO products

(1) This section prescribes requirements to be met by MSO products for the definition of MSO product in section 5 of the Act.

(2) Gasoline and diesel must be able to be supplied and used for road transport consistent with the FQS Act.

Note: Gasoline and diesel reported under the POFR Act include various ethanol and biodiesel blends which meet this definition.

(3) Gasoline and diesel are taken to comply with subsection (2) at a particular time if relevant requirements for supply under the FQS Act are not met at that time, but will be met within 48 hours after that time.

Note: An example of such a situation is where a fuel settles to meet water and sediment standards.

(4) Kerosene must be:

(a) jet fuel as reported under the POFR rules; and

(b) saleable for air transport purposes in Australia.

7 Pipeline stocks

For subparagraph 20(1)(b)(iii) of the Act, the circumstances are:

(a) the MSO product is under the ownership and control of the entity covered by section 19 of the Act; and

(b) the MSO product is able to be accessed to assist mitigate a fuel security event; and

(c) the accounting and reporting of these products is provided for in an MSO compliance plan.

8 Excluded stocks

For subsection 20(2) of the Act, stocks of an MSO product are excluded if the stocks do not meet the standards required to comply with section 6.

9 Stocks within exclusive economic zone boundary

For subparagraph 21(b)(iv) of the Act, the circumstances are:

(a) the vessel is within the outer limits of Australia’s exclusive economic zone; or

(b) the vessel:

(i) is travelling directly to an Australian port; and

(ii) has entered Australia’s exclusive economic zone as part of the voyage under subparagraph (i); and

(iii) has temporarily exited Australia’s exclusive economic zone while en route to the Australian port.

Note: The expression exclusive economic zone is defined in section 2B of the Acts Interpretation Act 1901.

10 Jointly owned stocks

For subsection 22(2) of the Act, if more than one entity would be the holder of the same stocks of an MSO product under subsection 22(1) of the Act, the amount of stock held by each entity is to be:

(a) if a written agreement is in place between the entities which provides an allocation of stocks by the entities expressly for this paragraph—determined in accordance with that agreement; or

(b) otherwise—allocated to each entity based on their share of the ownership of the stocks.

11 Entity entitled to take ownership of stocks

For paragraph 23(c) of the Act, the legally enforceable arrangement must:

(a) be in writing; and

(b) provide entity 1 under section 23 of the Act a contractual right to take possession of the stocks and remove them from storage.

12 Reserved stocks

(1) For paragraph 24(c) of the Act, the legally enforceable arrangement must:

(a) be in writing; and

(b) expressly allocate the stock to entity 1 under section 24 of the Act; and

(c) specify a period for which they are allocated.

(2) However, a legally enforceable arrangement must not allocate stock that is a feedstock under section 25 of the Act to an entity outside of the corporate group of the entity covered by paragraph 25(1)(a) of the Act.

13 Refinery feedstocks—crude oil

For subsection 25(1) of the Act, the quantity of diesel, gasoline and kerosene per megalitre of crude oil is to be calculated by applying:

(a) the yields for the refinery applicable under section 12 of the FSSP Rule; or

(b) the current yields for the refinery, based on at least a month of production volumes.

14 Refinery feedstocks—unfinished refinery product

(1) For paragraph 25(3)(c) of the Act, an unfinished refinery product is prescribed if:

(a) the product is reasonably expected to be transformed into an MSO product at the refinery; and

(b) after transformation into an MSO product, the volume of the MSO product is expected to be more than 80% of the volume of the unfinished refinery product being stored at the refinery.

(2) For subsection 25(1) of the Act, the quantity of diesel, gasoline and kerosene per megalitre of unfinished refinery product is to be calculated by applying a methodology set out in the entity’s MSO compliance plan.

(3) The methodology under subsection (2) must:

(a) be consistent with the composition and expected transformation of the unfinished refinery product; and

(b) not result in a total quantity of diesel, gasoline or kerosene that is greater than the quantity of the unfinished refinery product.

Part 3—Application of MSO

15 Obligation days

(1) For definition of obligation day in section 5 of the Act, the following days are prescribed:

(a) 4 July 2023;

(b) each Tuesday two weeks after the previous obligation day until 1 July 2024;

(c) each subsequent Tuesday after 1 July 2024.

(2) However, if the Tuesday is a public holiday in the Australian Capital Territory, the obligation day is the next day which is not a public holiday.

16 Trigger assessment period

For paragraph 10(1)(b) of the Act, the following periods (trigger assessment periods) are prescribed:

(a) the 2019 calendar year;

(b) the 2022 calendar year;

(c) each subsequent calendar year.

17 Thresholds to trigger MSO

(1) For subparagraph 10(1)(b)(ii) of the Act, unless subsection (2) applies, the volume of each MSO product necessary to trigger the MSO for the activity of refining or importing is as follows:

(a) gasoline—200 megalitres;

(b) diesel—250 megalitres;

(c) kerosene—250 megalitres.

(2) If the Secretary is satisfied that the entity’s refining or importing is carried out with a purpose or object of avoiding the threshold in subsection (1), the volume of each MSO product necessary to trigger the MSO for the activity of refining or importing is as follows:

(a) gasoline—10 megalitres;

(b) diesel—10 megalitres;

(c) kerosene—10 megalitres.

18 Notice window and advice window

(1) For subsection 15(5) of the Act, a notice window is:

(a) the period that begins on 1 March 2024 and ends on 30 June 2024; and

(b) each subsequent period that begins on 1 March of a particular year and ends on 30 June of that year.

(2) For subsection 16(4) of the Act, an advice window is a period of 2 months.

Note: An advice window ends at the start of a notice window (subsection 16(4) of the Act).

19 Notices to Australian controlling corporation

If the Secretary gives a notice to an entity under subsections 10(1), 15(1), 18(2), 18(5), 29(2), 29(7), 29(8) or 32(3) of the Act, the Secretary must take reasonable steps to also give a copy of the notice to any Australian controlling corporation of the entity.

Part 4—Designated quantity

20 Designated quantity to be specified

For subsections 10(3), 15(3) and 16(3) of the Act, the designated quantity of stocks of each MSO product the entity must hold on obligation days for which the notice is in force, or expects to be notified of for section 16 of the Act, must be calculated in accordance with this Part.

21 Designated quantity—general

(1) For each MSO product, the designated quantity is the sum of the quantities required for importing the product under subsection (2) and the quantities required for refining the product under subsection (3), rounded to the nearest megalitre.

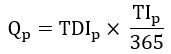

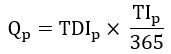

(2) If the MSO is triggered for the activity of importing an MSO product (p), the quantity for that product is given by the following formula:

where:

Qp is the designated quantity of the MSO product p, in megalitres.

TDIp is target days for the importing of the MSO product p declared under section 14 of the Act and applicable to the start of the period when the designated quantity will apply.

TIp is, subject to subsections (5) and (6), the total amount of the MSO product imported by the entity for the most recent completed trigger assessment period, in megalitres:

(a) as reported under section 19F of the POFR rules; or

(b) if not so reported—calculated for the trigger assessment period based on relevant N10 forms and N30 forms for the period.

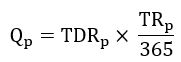

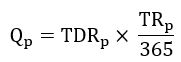

(3) If the MSO is triggered for the activity of refining an MSO product (p), the quantity for that product is given by the following formula:

where:

Qp is the designated quantity of the MSO product p, in megalitres.

TDRp is target days for the refining of the MSO product p declared under section 14 of the Act and applicable to the start of the period when the designated quantity will apply.

TRp is, subject to subsection (5), the total amount of MSO product refined by the entity for the most recent completed trigger assessment period, in megalitres.

(4) In this section, the volumes of MSO product imported or refined under subsections (2) and (3) include gasoline, diesel or kerosene which is intended to be sold as an MSO product, but does not yet meet the relevant specifications to be an MSO product.

(5) If during a trigger assessment period the production of an MSO product at a refinery was curtailed for one or more months due to the Refinery Upgrades Program and the entity is subject to the MSO for the activity of importing and refining:

(a) TRp under subsection (3) must be calculated based on the previous trigger assessment period; and

(b) the difference between the refining of the MSO product in the trigger assessment period and the refining of the MSO product in the previous assessment period must be deducted from TIp under subsection (2).

(6) If a volume of MSO product is imported by two entities in the circumstances covered by section 5, the amount imported by the first entity is to be disregarded.

22 Designated quantity—circumstances impacting entity during trigger assessment period

(1) If the Secretary is satisfied that all of the following apply, the designated quantity for each MSO product calculated under section 21 may be reduced by no more than the amount calculated under subsections (2) and (3):

(a) during the most recent trigger assessment period, the entity lost a major customer for one or more MSO products;

(b) the entity’s need to import or refine one or more MSO products for the remainder of the period was reduced as a result of the circumstances in paragraph (a) by more than the lesser of the following:

(i) 20% of the entity’s importing and refining;

(ii) 100 megalitres.

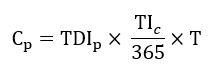

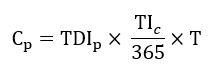

(2) If the MSO is triggered for the activity of importing an MSO product (p), the amount is given by the following formula:

where:

Cp is the amount by which the designated quantity may be reduced for the MSO product p.

TDIp is target days for importing the MSO product p declared under section 14 of the Act and applicable to the start of the period when the designated quantity will apply.

TIc is the total amount of MSO product p that the entity would have imported for the purpose of the contract with the major customer that was lost, in megalitres.

T is equal to 12 minus the number corresponding to the month of the year in which the entity lost the contract with the major customer, divided by 12.

Note: T corresponds to the number of full months during the trigger assessment period in which the entity would have ceased importing the MSO product for the purpose of the contract with the major customer that was lost.

Example: If the entity lost the contract with a major customer in April, the number corresponding to the month of the year in which the entity lost the contract with the major customer would be 4, and T would equal  .

.

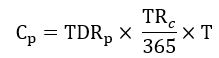

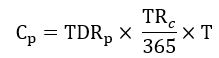

(3) If the MSO is triggered for the activity of refining an MSO product (p), the amount is given by the following formula:

where:

Cp is the amount by which the designated quantity may be reduced for the MSO product p.

TDRp is target days for refining the MSO product p declared under section 14 of the Act and applicable to the start of the period when the designated quantity will apply.

TRc is the total amount of MSO product p that the entity would have refined for the purpose of the contract with the major customer that was lost, in megalitres.

T is equal to 12 minus the number corresponding to the month of the year in which the entity lost the contract with the major customer, divided by 12.

Note: T corresponds to the number of full months during the trigger assessment period in which the entity would have ceased refining the MSO product for the purpose of the contract with the major customer that was lost.

Example: If the entity lost the contract with a major customer in October, the number corresponding to the month of the year in which the entity lost the contract with the major customer would be 10, and T would equal  .

.

(4) If the entity lost more than 1 major customer during the most recent trigger assessment period, the total value of Cp may be calculated by applying the formula mentioned in subsection (2) or (3), as applicable, in respect of each major customer lost, and adding together the values of Cp.

23 Designated quantity—circumstances impacting MSO entity at commencement

(1) If the Secretary is satisfied that all of the following apply, the designated quantity for each MSO product calculated under section 21 may be reduced by no more than the amount calculated under subsection (2):

(a) the designated quantity is to apply in a period before 1 July 2025;

(b) the entity has taken all reasonable steps since the commencement of this section to prepare for meeting the MSO;

(c) the entity will be unable to meet the MSO if calculated under section 21 because:

(i) the storage owned, leased or otherwise available for the entity to use for one or more MSO products is unable to hold sufficient MSO products to meet the MSO; and

(ii) after market testing by the entity, there are no cost effective options for the entity to use section 24 arrangements to meet its obligations;

(d) the MSO compliance plan for the entity provides a credible path to compliance within the next 2 years;

(e) evidence has been provided to the Secretary to support each of the above paragraphs;

(f) the entity has provided information to the Secretary on the prices paid, or offered to it, for section 24 arrangements;

(g) if the designated quantity is to apply before 1 July 2024—the entity has made a written request to the Secretary for this section to apply on or before 28 February 2023;

(h) if the designated quantity is to apply on or after 1 July 2024—a request for this section to apply was included in the advice provided for subsection 16(1) of the Act.

(2) The amount is:

(a) if the Secretary is satisfied that the entity has given a credible commitment to construct additional storage infrastructure to enable the entity to comply with the MSO—25% of the amount calculated under section 21, rounded to the nearest megalitre; or

(b) otherwise, the lesser of:

(i) 25% of the amount calculated under section 21, rounded to the nearest megalitre; and

(ii) the following amounts for each MSO product:

(A) gasoline—15 megalitres;

(B) diesel—15 megalitres;

(C) kerosene—15 megalitres.

24 Designated quantity—entity consistently below threshold

If the total amount of an MSO product imported and refined by an entity in each of the three previous trigger assessment periods is below the threshold for that fuel applicable in subsection 17(1), and subsection 17(2) does not apply, the designed quantity for that MSO product is calculated under section 21 as if the quantity of that MSO product imported or refined is zero in the most recent trigger assessment period.

Part 5—Temporary reduction in designated quantities

25 Applications for temporary reduction in quantity of stocks

For paragraph 17(2)(c) of the Act, the requirements are that the application:

(a) be in a form approved in writing by the Secretary; and

(b) include evidence that the criteria in section 26 or section 27 are met.

26 Criteria for temporary reduction in quantity of stocks

(1) For subsection 18(6) of the Act, the Secretary may grant the application only if satisfied under subsection (2) or (3) or section 27.

(2) The Secretary may grant an application if satisfied that the reduction is necessary because of one of the following circumstances that was beyond the reasonable control of the entity:

(a) to carry out a tank inspection required by law or to comply with relevant maintenance standards for the equipment;

(b) a significant shipping disruption due to unforeseen circumstances;

(c) to repair infrastructure damaged where the applicant is not responsible for, or did not contribute to, the damage;

(d) where a supplier of imported fuel is required to comply with the requirements to be an MSO product, but supplies fuel to the entity which is not compliant.

(3) The Secretary may grant an application if satisfied that:

(a) the applicant has lost one or more major customers for one or more MSO products; and

(b) the applicant’s need to import or refine one or more MSO products for the remainder of the period is reduced as a result of the circumstances in paragraph (a) by more than the lesser of:

(i) 20% of the applicant’s importing and refining; and

(ii) 100 megalitres.

(4) The reduction in the quantity under subsection (2) must be no more than necessary, and for no longer than is necessary, to address the circumstance covered by that subsection.

27 Additional transitional reduction in quantity of stocks

For subsection 18(6) of the Act, the Secretary may also grant an application if satisfied that:

(a) the designated quantity to be reduced relates to a period before 1 July 2024; and

(b) the designated quantity was set based on information or data that the Secretary is satisfied was incorrect; and

(c) the reduction in quantity is consistent with that which would have been set if the correct information or data had been used.

Example: If the Secretary has triggered the MSO for an entity in relation to an MSO product under section 10 of the Act based on incorrect data on the quantity of product imported or refined by the entity, the Secretary may decide to reduce the quantity after receiving an application under section 17 of the Act. This section also applies to notices of quantity of MSO product under sections 15 or 18 of the Act that are based on incorrect information about amount of MSO products imported or refined by the entity.

Part 6—Suspension of MSO

28 Suspension by Minister

For paragraph 27(1)(b) of the Act, the following requirements are prescribed:

(a) the suspension is no longer than is reasonably necessary to prevent or alleviate the disruption or likely disruption to supply;

(b) Energy Ministers (within the meaning of the Liquid Fuel Emergency Act 1984) have been informed of the proposed suspension.

29 Application for suspension by Secretary

For subsection 28(2) of the Act, the requirements are that the application:

(a) set out the proposed end date for the suspension; and

(b) set out the reasons why the MSO should be suspended for the entity, having regard to section 30; and

(c) provide an estimate of when stock would be held consistent with the MSO if the suspension were granted, and the reasons for this estimate; and

(d) provide evidence to substantiate the matters referred to in paragraphs (b) and (c); and

(e) provide details of any other entities who should, or should not, be included in a class of entities covered by the suspension; and

(f) include the latest MSO compliance plan for the entity; and

(g) set out why implementing their MSO compliance plan would not avoid a breach of the MSO without the suspension; and

(h) be in a form approved by the Secretary.

30 Secretary’s decision on suspension

(1) This section prescribes requirements for subsection 29(2) of the Act.

(2) The Secretary may grant an application only if satisfied that:

(a) compliance with the MSO would mean that the supply of one or more MSO products to fuel users has been, or is likely to be, disrupted; and

(b) the applicant substantiates the need to suspend the MSO.

(3) The Secretary must refuse an application if satisfied that:

(a) the likely breach of the MSO by the applicant was caused, wholly or partially, by deficiencies in the entity’s MSO compliance plan; or

(b) the reasons for the suspension would be more appropriately dealt with by a decision under section 18 of the Act to reduce the quantity of stocks for one or more entities under the MSO.

Note: Each entity would need to make their own application under section 17 of the Act for this to occur.

(4) In deciding whether to grant or refuse an application in circumstances covered by subsection (2), the Secretary must take into account:

(a) the likelihood and impacts of disruption to fuel supply without a suspension; and

(b) whether the applicant has taken all reasonable steps to avoid the need to suspend the MSO, including through arrangements under section 24 of the Act; and

(c) any impacts on competition in the markets for MSO products from the suspension; and

(d) that the period of any suspension should be no longer than reasonably necessary to address the reasons for suspension; and

(e) whether implementing the MSO compliance plan will bring the applicant back into compliance in a timely manner; and

(f) any other matters the Secretary considers relevant.

(5) The Secretary must take all reasonable steps to make a decision on an application:

(a) if further information has been required—within 30 days of that information being provided; and

(b) otherwise—within 30 days after the application was made.

(6) If appropriate, the Secretary may start the suspension period from a time after the reason for the suspension arose but before the decision on the suspension is made.

31 Class of entities included in a suspension

For subsection 29(3) of the Act, the Secretary may include a class of entities in the suspension if satisfied that:

(a) the entities are in the same situation as the applicant or are likely to be similarly affected; and

(b) not including the entities in the class could impact competition in one or more markets for MSO products.

Note: Under subsection 29(3) of the Act, the Secretary may do this on their own initiative, irrespective of who the applicant seeks to be included in a class of entities.

Part 7—Notice of intention to cease all MSO activities in relation to MSO product

32 Requirements for notice of intention to cease MSO activities

For subsection 31(2) of the Act, a notice that the entity intends to permanently or indefinitely cease undertaking all MSO activities in relation to one or more MSO products must:

(a) set out which MSO products the entity will cease to refine or import; and

(b) explain the reasons and timeframe for paragraph (a); and

(c) set out the names of any entity likely to carry on the MSO activity in place of the entity providing the notice and, to the extent practicable, what level of obligation should be allocated to each entity under a determination under section 37 of the Act; and

(d) provide evidence to substantiate the claims made in the notice.

Part 8—Audit

33 Conduct of audits under section 33 or section 34 of the Act

(1) For the purposes of subsection 35(1) of the Act, this section prescribes requirements to be met by registered greenhouse and energy auditors in carrying out audits under section 33 or section 34 of the Act.

(2) The audit report must be prepared by a registered greenhouse and energy auditor in accordance with the requirements for reasonable assurance engagements or limited assurance engagements under the NGER (Audit) Determination, as specified in the relevant notice for paragraph 33(3)(a) or paragraph 34(2)(c) of the Act.

(3) The registered greenhouse and energy auditor must take all reasonable steps to prevent unauthorised use or disclosure of information obtained when conducting an audit.

Part 9—MSO compliance plan

34 Operation of this Part

For paragraph 36(1)(a) of the Act, this Part prescribes matters that must be dealt with by an MSO compliance plan prepared, and kept up to date, by an entity subject to the MSO.

Note: Subsection 36(2) of the Act requires these plans to also deal with any matters requested by the Secretary under that subsection.

35 What an MSO compliance plan must contain—outline

(1) An MSO compliance plan must include the following:

(a) an outline of the organisational structure of the entity;

(b) a list of key people in the entity, their role and contact details;

(c) a check list of where the plan implements the requirements in this instrument.

(2) An MSO compliance plan must set out the processes for review of the plan and keeping the plan up to date.

(3) An MSO compliance plan must contain a statement signed on behalf of the entity subject to the MSO acknowledging its organisational commitment to the plan.

36 What an MSO compliance plan must contain—overview of current practices

An MSO compliance plan must set out the entity’s current procedures for managing each MSO activity they undertake, including:

(a) a description of the frequency with which MSO products are imported; and

(b) the volume of the entity’s capacity to store each MSO product; and

(c) the location of facilities at which the entity stores MSO products; and

(d) details of usual fluctuations in the storage of MSO products; and

(e) a description of the entity’s obligations under any significant ongoing contracts for the supply of MSO products.

37 What an MSO compliance plan must contain—compliance pathway

(1) An MSO compliance plan must list the steps and strategies the entity:

(a) is taking to comply with its MSO; and

(b) intends to take if it becomes aware of future or current non-compliance, including relevant contingency plans; and

(c) if the entity is not compliant—is taking to bring the entity back into compliance and avoid future non-compliance.

(2) The steps and strategies the entity is taking to comply with its MSO may include any of the following:

(a) building more storage;

(b) increasing import frequency;

(c) arrangements to hold stocks under sections 23 or 24 of the Act;

(d) adapting current business practices.

(3) If the entity intends to allow its stock to be held by another under section 23 or 24 of the Act, the MSO compliance plan must set out the entity’s approach and processes for that to occur.

38 What an MSO compliance plan must contain—data collection, reporting and record keeping

(1) An MSO compliance plan must set out the entity’s current methodology and practice for counting stock, including:

(a) a comment on the accuracy of data; and

(b) if stock is held in reliance upon sections 7 or 9—the arrangements to ensure the accuracy of these amounts; and

(c) if a methodology is required under subsection 14(2)—that methodology.

(2) An MSO compliance plan must set out the entity’s reporting and recordkeeping framework, including:

(a) a description of the quality assurance process; and

(b) a description of reporting approvals required; and

(c) how reporting of arrangements under sections 23 and 24 of the Act are managed; and

(d) the process for providing advice required by section 16 of the Act; and

(e) the arrangements for keeping records in an auditable form and how those records can be accessed.

39 What an MSO compliance plan must contain—schedule of future outages

An MSO compliance plan must set out any known future scheduled maintenance for any refineries, storage tanks or pipelines where it may lead to an application under section 17 of the Act.

40 Provision of MSO compliance plan to Secretary

For subsection 36(3) of the Act, an entity required to have an MSO compliance plan on 4 July 2023 must make available to the Secretary a copy of that plan by 31 July 2023.

Part 10—Assumption or division of MSO

41 Assumption or division

(1) For subsection 37(7) of the Act, the Secretary may provide one or more of the following in a determination under subsection 37(1) of the Act:

(a) that a notice is taken to have been given to more than one entity;

(b) that a notice is taken to have been given to a different entity;

(c) that a notice is taken to specify a different quantity.

(2) The Secretary must take the following into account in making a determination:

(a) the principle that the level of MSO should reflect the likely importing and refining activity of each entity;

(b) the desirability that the total level of MSO from all notices after the determination be no less than the total level of the MSO before the determination.

Part 11—Monitoring secondary markets and assisting compliance

42 Monitoring of secondary market activity and assisting compliance

(1) The Secretary must take reasonable steps to monitor the availability and price of section 24 arrangements to assist entities to comply with the MSO.

(2) The Secretary may publish information or provide assistance to entities relating to their compliance with the MSO.

Part 12—Publication of information

43 Information publication

(1) As soon as practicable before each 1 July, the Secretary must publish on the Department’s website:

(a) the number of entities subject to the MSO for each MSO product; and

(b) the total volume in megalitres of each MSO product that is required to be held on the first obligation day of the financial year by all entities subject to the MSO; and

(c) an estimate of the aggregate percentage of all importing and refining of each MSO product undertaken by entities subject to the MSO for that product based upon:

(i) the volumes of imported and refined MSO products from the previous financial year; and

(ii) the entities subject to the MSO during the previous financial year.

(2) If the Secretary makes a decision to reduce a quantity under section 18 of the Act or to suspend the MSO under section 29 of the Act, the Secretary may publish general information about the decision on the Department’s website.

(3) The Secretary must not cause to be published or made available information under this section if the information is:

(a) likely to enable the identification of a person; or

(b) commercial-in-confidence.