Carbon Credits (Carbon Farming Initiative) Amendment (No. 2) Rules 2023

I, Chris Bowen, Minister for Climate Change and Energy, make the following rules.

Dated 3 May 2023

Chris Bowen

Minister for Climate Change and Energy

Carbon Credits (Carbon Farming Initiative) Amendment (No. 2) Rules 2023

I, Chris Bowen, Minister for Climate Change and Energy, make the following rules.

Dated 3 May 2023

Chris Bowen

Minister for Climate Change and Energy

Contents

2 Commencement

3 Authority

4 Schedules

Schedule 1—Amendments

Carbon Credits (Carbon Farming Initiative) Rule 2015

This instrument is the Carbon Credits (Carbon Farming Initiative) Amendment (No. 2) Rules 2023.

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after registration of this instrument. |

|

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

This instrument is made under section 308 of the Carbon Credits (Carbon Farming Initiative) Act 2011.

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Carbon Credits (Carbon Farming Initiative) Rule 2015

1 After subsection 9(7)

Insert:

Requirement relating to activities to reduce covered emissions of greenhouse gases at designated large facilities

(8) It is an eligibility requirement that, if the project involved an activity that the project proponent began to undertake after the commencement of this subsection (the new activity), the new activity must not have resulted in carbon abatement of covered emissions of greenhouse gases from the operation of a designated large facility, unless the requirements in subsection (9) have been met.

(9) The requirements are:

(a) the new activity was described in the application under section 22 of the Act for the declaration of the project as an eligible offsets project; or

(c) all of the following apply:

(i) the new activity also resulted in carbon abatement of emissions other than covered emissions of greenhouse gases from the operation of the designated large facility;

(ii) the methodology determination that covers the project provides a method for working out the carbon dioxide equivalent net abatement amount for the project in relation to the reporting period that does not include carbon abatement of covered emissions from the operation of the designated large facility;

(iii) that method was used when the carbon dioxide equivalent net abatement amount for the project was worked out in relation to the reporting period.

(10) In subsection (8), operation has the same meaning as in the NGER Act.

2 After section 10

Insert:

(1) This section is made for the purposes of subsection 20C(3) of the Act.

(2) An eligible offsets project that is likely to involve carbon abatement of covered emissions of greenhouse gases from the operation of a designated large facility for a financial year, and which does not meet all of the criteria in subsection (3), is specified.

(3) The criteria are:

(a) the project must also be likely to involve carbon abatement of emissions other than covered emissions of greenhouse gases from the operation of the designated large facility;

(b) the methodology determination that covers the project must provide a method for working out the carbon dioxide equivalent net abatement amount for the project in relation to a reporting period that does not include carbon abatement of covered emissions from the operation of the designated large facility;

(c) that method must be used when working out the carbon dioxide equivalent net abatement amount for the project in relation to a reporting period.

(4) In this section, operation has the same meaning as in the NGER Act.

3 After section 11A

Insert:

11AB Regulator may sell Australian carbon credit units in Commonwealth Emissions Reduction Fund Delivery Account

(1) This section is made for the purposes of paragraph 20H(1)(aa) of the Act.

(2) The Regulator may sell one or more Australian carbon credit units held in the Commonwealth registry account designated as the Commonwealth Emissions Reduction Fund Delivery Account in the circumstances specified in subsection (3), for the price specified in subsection (4).

(3) The circumstances are:

(a) the units will be purchased by a responsible emitter for a designated large facility (the purchaser); and

(b) the sale will occur pursuant to a contract between the Regulator and the purchaser; and

(c) under the contract, the purchaser must agree to surrender the units under section 22XN of the NGER Act for the purpose of reducing the net emissions number of the facility for a specified period; and

(d) at the time the Regulator enters into the contract, the Regulator is satisfied:

(i) that the surrender is for the purpose of ensuring that an excess emissions situation does not exist in relation to the facility for the period; and

(ii) that the conditions in paragraphs 22XN(1)(a)-(c) of the NGER Act will be met in relation to the proposed surrender; and

(e) the units will be transferred to the purchaser on or after 1 July 2023.

(4) The price is $75 per Australian carbon credit unit, indexed in accordance with section 11AC.

Note: Section 11AC provides for the price to be indexed from 1 July 2024 and in subsequent financial years by a rate calculated by reference to the increase to the All Groups Consumer Price Index, plus 2 per cent.

(5) The following expressions used in subsection (3) have the same meaning as in the NGER Act:

(a) excess emissions situation;

(b) net emissions number;

(c) responsible emitter.

(6) To avoid doubt, a contract under paragraph (3)(b) for the sale of Australian carbon credit units by the Regulator is taken not to be an instrument made under the Act.

11AC Indexation of price of Australian carbon credit units for sale by Regulator

(1) At the start of each financial year (an indexation year) beginning on or after 1 July 2024, the price specified in subsection 11AB(4) is replaced by the amount worked out using the following formula:

Indexation factor for the indexation year × Dollar amount for the previous year

(2) The indexation factor for an indexation year is the number worked out using the following formula:

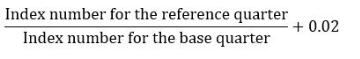

where:

base quarter means the last March quarter before the reference quarter.

index number, for a quarter, means the All Groups Consumer Price Index number (being the weighted average of the 8 capital cities) published by the Australian Statistician for that quarter.

reference quarter means the March quarter immediately before the indexation year.

(3) An indexation factor is to be calculated to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(4) If an indexation factor worked out under subsection (2) would be less than 1, that indexation factor is to be increased to 1.

(5) Calculations under subsection (2):

(a) are to be made using only the index numbers published in terms of the most recently published index reference period; and

(b) are to be made disregarding index numbers that are published in substitution for previously published index numbers (except where the substituted numbers are published to take account of changes in the index reference period).

(6) An amount worked out under subsection (1) is to be calculated to 2 decimal places (rounding up if the third decimal place is 5 or more).