| Most recent period -2 years | Most recent period -1 year | Most recent period |

| (1) | (2) | (3) |

1.1. Interest, lease and dividend | | | |

1.1.1. Total interest income | | | |

1.1.1.1. Interest income calculated using the effective interest method | | | |

1.1.1.2. Lease income on operating leases | | | |

1.1.1.3. Interest income from finance leases | | | |

1.1.1.4. Total interest income adjustment | | | |

1.1.1.4.1. Mergers and acquisitions | | | |

1.1.1.4.2. Divestments | | | |

1.1.2. Interest expense | | | |

1.1.2.1. Interest expense | | | |

1.1.2.2. Interest expense on lease liabilities | | | |

1.1.2.3. Depreciation and amortisation expense | | | |

1.1.2.4. Interest expense adjustment | | | |

1.1.2.4.1. Mergers and acquisitions | | | |

1.1.2.4.2. Divestments | | | |

1.1.3. Interest-earning assets | | | |

1.1.3.1. Loans and advances | | | |

1.1.3.2. Trading securities | | | |

1.1.3.3. Investment securities | | | |

1.1.3.4. Property, plant and equipment under operating leases | | | |

1.1.3.5. Finance lease receivables | | | |

1.1.3.6. Interest-earning assets adjustment | | | |

1.1.3.6.1. Mergers and acquisitions | | | |

1.1.3.6.2. Divestments | | | |

1.1.4. Dividend income | | | |

1.1.4.1. Dividend income | | | |

1.1.4.2. Dividend income adjustment | | | |

1.1.4.2.1. Mergers and acquisitions | | | |

1.1.4.2.2. Divestments | | | |

1.2. Services | | | |

1.2.1. Fee and commission income | | | |

1.2.1.1. Fee and commission income | | | |

1.2.1.2. Fee and commission income adjustment | | | |

1.2.1.2.1. Mergers and acquisitions | | | |

1.2.1.2.2. Divestments | | | |

1.2.2. Fee and commission expense | | | |

1.2.2.1. Fee and commission expense | | | |

1.2.2.2. Fee and commission expense adjustment | | | |

1.2.2.2.1. Mergers and acquisitions | | | |

1.2.2.2.2. Divestments | | | |

1.2.3. Other operating income | | | |

1.2.3.1. Other operating income | | | |

1.2.3.2. Other operating income adjustment | | | |

1.2.3.2.1. Mergers and acquisitions | | | |

1.2.3.2.2. Divestments | | | |

1.2.4. Other operating expense | | | |

1.2.4.1. Other operating expense | | | |

1.2.4.2. Other operating expense adjustment | | | |

1.2.4.2.1. Mergers and acquisitions | | | |

1.2.4.2.2. Divestments | | | |

1.3. Financial | | | |

1.3.1. Trading book net profit/loss | | | |

1.3.1.1. Trading book net profit/loss | | | |

1.3.1.2. Trading book net profit/loss adjustment | | | |

1.3.1.2.1. Mergers and acquisitions | | | |

1.3.1.2.2. Divestments | | | |

1.3.2. Banking book net profit/loss | | | |

1.3.2.1. Banking book net profit/loss | | | |

1.3.2.2. Banking book net profit/loss adjustment | | | |

1.3.2.2.1. Mergers and acquisitions | | | |

1.3.2.2.2. Divestments | | | |

Banking book | Has the meaning given in Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book (Advanced ADIs). |

Business indicator | Has the meaning given in APS 115. |

Depreciation and amortisation expense | Means depreciation and impairment of right-of-use operating lease assets measured in accordance with Australian Accounting Standard AASB 16 Leases (AASB 16). |

Dividend income | Means dividend income from investments in stocks and funds not consolidated in the ADI’s financial statements, including dividend income from non-consolidated subsidiaries, joint ventures and associates. Measure dividend income in accordance with Australian Accounting Standard AASB 9 Financial Instruments (AASB 9). |

Fee and commission expense | Means expenses paid for receiving advice and services. This includes but is not limited to expenses paid for: - outsourcing of financial services;

- clearing and settlement;

- custody;

- servicing of securitisations;

- loan commitments and guarantees received; and

- foreign transactions.

This excludes outsourcing fees paid for the supply of non-financial services (e.g. logistical, IT, or human resources). Measure fee and commission expense in accordance with Australian Accounting Standard AASB 7 Financial Instruments: Disclosures (AASB 7). |

Fee and commission income | Means income received from providing advice and services. This includes but is not limited to income from: - securities services (e.g. issuance, origination, reception, transmission, or execution on behalf of customers);

- clearing and settlement services;

- asset management and custody services;

- fiduciary transactions;

- payment services;

- structured finance;

- servicing of securitisations;

- loan commitments and guarantees given;

- foreign transactions; and

- providing outsourced financial services.

Measure fee and commission income in accordance with AASB 7. |

Finance lease receivables | Means assets held under a finance lease presented as receivables as defined in AASB 16. |

Interest-earning assets | Means the sum of loans and advances, trading securities, investment securities, property, plant and equipment under operating leases, finance lease receivables, and the interest-earning assets adjustment. |

Interest expense (financial liabilities) | Means interest expenses from financial liabilities excluding interest expense on lease liabilities and depreciation and amortisation expense. This includes but is not limited to interest expense from deposits, debt securities issued, and hedge accounting derivatives. |

Interest expense on lease liabilities | Means interest expense from lease liabilities, measured in accordance with AASB 16. This includes but is not limited to losses from leased assets and interest expense on lease liabilities. Exclude depreciation and impairment of right-of-use operating lease assets. Report this under depreciation and amortisation expense. |

Interest income calculated using the effective interest method | Means interest income calculated using the effective interest method as outlined in AASB 7 and Australian Accounting Standard AASB 101 Presentation of Financial Statements (AASB 101). |

Interest income from finance leases | Means interest income received from financial leases, as defined in AASB 16. This includes but is not limited to: - profits/losses from sale of finance leases;

- finance income on the net investment in finance leases; and

- income related to variable lease payments not included in the net investment in finance leases.

|

Investment securities | Means securities that are not trading securities. These are generally securities purchased with the intent that they be held to maturity or held for a period of time though not necessarily to maturity (i.e. equity securities where it is not technically possible to hold to maturity). |

Lease income on operating leases | Means income from operating leases as outlined in AASB 16 and Australian Accounting Standard AASB 140 Investment Property (AASB 140). |

Loans and advances | Means total gross outstanding loans and advances measured in accordance with AASB 7. |

Net profit/loss from the banking book | Means net profit/loss from the banking book. This may include net profit/loss from: - financial assets and liabilities measured at fair value through profit or loss in accordance with AASB 7;

- realised gains/losses on financial assets and liabilities not measured at fair value through profit and loss (e.g. loans and advances, assets available for sale, assets held to maturity, and financial liabilities measured at amortised cost);

- hedge accounting; and

- exchange differences.

|

Net profit/loss from the trading book | Means net profit/loss from the trading book. This may include net profit/loss from: - trading assets and trading liabilities (e.g. derivatives, debt securities, equity securities, loans and advances, short positions, and other trading assets and liabilities);

- hedge accounting; and

- exchange differences.

|

Other operating expenses | Means expenses and losses from ordinary banking operations not included in other business indicator items but of a similar nature, or from operational loss events. This may include, but is not limited to: - losses from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations (measured in accordance with Australian Accounting Standard AASB 5 Non-current Assets Held for Sale and Discontinued Operations (AASB 5));

- losses incurred as a consequence of operational loss events (e.g. fines, penalties, settlements, or replacement cost of damaged assets), which have not been provisioned/reserved for in previous years (measured in accordance with AASB 101); and

- expenses related to establishing provisions/reserves for operational loss events (measured in accordance with Australian Accounting Standard AASB 137 Provisions, Contingent Liabilities and Contingent Assets).

Exclude losses from operating leases. |

Other operating income | Means income from ordinary banking operations not included in other business indicator items but of a similar nature. This may include, but is not limited to: - rental income from investment properties (measured in accordance with AASB 140); and

- gains from non-current assets and disposal groups classified as held for sale and not qualifying as discontinued operations (measured in accordance with AASB 101 and AASB 5).

Exclude income from operating leases. |

Property, plant and equipment under operating leases | Means property, plant and equipment subject to an operating lease as defined in AASB 16. |

Total interest expense | Means interest expenses from all financial liabilities and other interest expenses. This includes but is not limited to: - interest expenses from deposits, debt securities issued, financial leases, and operating leases;

- interest expenses from hedge accounting derivatives;

- other interest expenses;

- losses from leased assets; and

- depreciation and impairment of operating leased assets.

Total interest expense is calculated as the sum of interest expense, interest expense on lease liabilities, depreciation and amortisation expense, and any adjustments to total interest expense. |

Total interest income | Means interest income from all financial assets and other interest income. This includes but is not limited to: - interest income from loans and advances;

- interest income from assets available for sale;

- interest income from assets held to maturity and trading assets;

- interest income from financial and operating leases;

- profits from leased assets;

- interest income from hedge accounting derivatives; and

- other interest income.

Total interest income is calculated as the sum of interest income calculated using the effective interest method, lease income on operating leases, interest income from finance leases, and interest income adjustment. |

Trading book | Has the meaning given in Prudential Standard APS 116 Capital Adequacy: Market Risk. |

Trading securities | Has the same meaning as securities held for trading as defined in AASB 9. |

Item 1.1.1 | Report the value of total interest income earned during the relevant period. Item 1.1.1 is a derived item. Report the value of total interest income earned in item 1.1.1 as the sum of items 1.1.1.1 to 1.1.1.4 inclusive. |

Item 1.1.1.1 | Report the value of interest income calculated using the effective interest method earned during the relevant period. |

Item 1.1.1.2 | Report the value of lease income on operating leases earned during the relevant period. |

Item 1.1.1.3 | Report the value of interest income from financial leases earned during the relevant period. |

Item 1.1.1.4 | Report any adjustments to total interest income for previous periods. Item 1.1.1.4 is a derived item. Report the value of adjustments to total interest income for previous periods in item 1.1.1.4 as the sum of item 1.1.1.4.1 and item 1.1.1.4.2. |

Item 1.1.1.4.1 | Report the value of any adjustments to total interest income for previous periods due to mergers and/or acquisitions. |

Item 1.1.1.4.2 | Report the value of any adjustments to total interest income for previous periods due to divestments. |

Item 1.1.2 | Report the value of total interest expense incurred during the relevant period. Item 1.1.2 is a derived item. Report the total interest expense in item 1.1.2 as the sum of items 1.1.2.1 to 1.1.2.4 inclusive. |

Item 1.1.2.1 | Report the value of interest expense incurred during the relevant period. |

Item 1.1.2.2 | Report the value of interest expense on lease liabilities incurred during the relevant period. |

Item 1.1.2.3 | Report the value of depreciation and amortisation expense incurred during the relevant period. |

Item 1.1.2.4 | Report the value of any adjustments to total interest expense for previous periods. Item 1.1.2.4 is a derived item. Report the value of adjustments to total interest expense for previous periods in item 1.1.2.4 as the sum of item 1.1.2.4.1 and item 1.1.2.4.2. |

Item 1.1.2.4.1 | Report the value of any adjustments to total interest expense for previous periods due to mergers and/or acquisitions. |

Item 1.1.2.4.2 | Report the value of any adjustments to total interest expense for previous periods due to divestments. |

Item 1.1.3 | Report the value of interest-earning assets as at the end of the relevant period. Item 1.1.3 is a derived item. Report the value of interest-earning assets in item 1.1.3 as the sum of items 1.1.3.1 to 1.1.3.6 inclusive. |

Item 1.1.3.1 | Report the value of loans and advances as at the end of the relevant period. |

Item 1.1.3.2 | Report the value of trading securities as at the end of the relevant period. |

Item 1.1.3.3 | Report the value of investment securities as at the end of the relevant period. |

Item 1.1.3.4 | Report the value of property, plant and equipment under operating leases as at the end of the relevant period. |

Item 1.1.3.5 | Report the value of finance lease receivables as at the end of the relevant period. |

Item 1.1.3.6 | Report any adjustments to interest-earning assets for previous periods. Item 1.1.3.6 is a derived item. Report the value of adjustments to interest-earning assets for previous periods in item 1.1.3.6 as the sum of item 1.1.3.6.1 and item 1.1.3.6.2. |

Item 1.1.3.6.1 | Report the value of any adjustments to interest-earning assets for previous periods due to mergers and/or acquisitions. |

Item 1.1.3.6.2 | Report the value of any adjustments to interest-earning assets for previous periods due to divestments. |

Item 1.1.4 | Report the value of dividend income earned during the relevant period. Item 1.1.4 is a derived item. Report the value of dividend income as the sum of item 1.1.4.1 and item 1.1.4.2. |

Item 1.1.4.1 | Report the value of dividend income earned during the relevant period. |

Item 1.1.4.2 | Report any dividend income adjustments for previous periods. Item 1.1.4.2 is a derived item. Report the value of adjustments to dividend income for previous periods in item 1.1.4.2 as the sum of item 1.1.4.2.1 and item 1.1.4.2.2. |

Item 1.1.4.2.1 | Report the value of any adjustments to dividend income for previous periods due to mergers and/or acquisitions. |

Item 1.1.4.2.2 | Report the value of any adjustments to dividend income for previous periods due to divestments. |

Item 1.2.1 | Report the value of fee and commission income earned during the relevant period. Item 1.2.1 is a derived item. Report value of fee and commission income in item 1.2.1 as the sum of item 1.2.1.1 and item 1.2.1.2. |

Item 1.2.1.1 | Report the value of fee and commission income earned during the relevant period. |

Item 1.2.1.2 | Report any fee and commission income adjustments for previous periods. Item 1.2.1.2 is a derived item. Report the value of fee and commission income adjustments in item 1.2.1.2 as the sum of item 1.2.1.2.1 and item 1.2.1.2.2. |

Item 1.2.1.2.1 | Report the value of any adjustments to fee and commission income for previous periods due to mergers and/or acquisitions. |

Item 1.2.1.2.2 | Report the value of any adjustments to fee and commission income for previous periods due to divestments. |

Item 1.2.2 | Report the value of fee and commission expense incurred during the relevant period. Item 1.2.2 is a derived item. Report the value of fee and commission expense in item 1.2.2 as the sum of item 1.2.2.1 and item 1.2.2.2. |

Item 1.2.2.1 | Report fee and commission expense incurred during the relevant period. |

Item 1.2.2.2 | Report any fee and commission expense adjustments for previous periods. Item 1.2.2.2 is a derived item. Report the value of adjustments to fee and commission expense for previous periods in item 1.2.2.2 as the sum of item 1.2.2.2.1 and item 1.2.2.2.2. |

Item 1.2.2.2.1 | Report the value of any adjustments to fee and commission expense for previous periods due to mergers and/or acquisitions. |

Item 1.2.2.2.2 | Report the value of any adjustments to fee and commission expense for previous periods due to divestments. |

Item 1.2.3 | Report the value of other operating income earned during the relevant period. Item 1.2.3 is a derived item. Report the value of other operating income in item 1.2.3 as the sum of item 1.2.3.1 and item 1.2.3.2. |

Item 1.2.3.1 | Report the value of other operating income earned during the relevant period. |

Item 1.2.3.2 | Report any other operating income adjustments for previous periods. Item 1.2.3.2 is a derived item. Report the value of other operating income adjustments in item 1.2.3.2 as the sum of item 1.2.3.2.1 and item 1.2.3.2.2. |

Item 1.2.3.2.1 | Report the value of any adjustments to other operating income for previous periods due to mergers and/or acquisitions. |

Item 1.2.3.2.2 | Report the value of any adjustments to other operating income for previous periods due to divestments. |

Item 1.2.4 | Report the value of other operating expenses incurred during the relevant period. Item 1.2.4 is a derived item. Report the value of other operating expenses in item 1.2.4 as the sum of item 1.2.4.1 and item 1.2.4.2. |

Item 1.2.4.1 | Report the value of other operating expenses incurred during the relevant period. |

Item 1.2.4.2 | Report any adjustments to other operating expenses for previous periods. Item 1.2.4.2 is a derived item. Report the value of adjustments to other operating expense for previous periods in item 1.2.4.2 as the sum of item 1.2.4.2.1 and item 1.2.4.2.2. |

Item 1.2.4.2.1 | Report the value of any adjustments to other operating expenses for previous periods due to mergers and/or acquisitions. |

Item 1.2.4.2.2 | Report the value of any adjustments to other operating expenses for previous periods due to divestments. |

Item 1.3.1 | Report the net profit/loss from the trading book for the relevant period. Item 1.3.1 is a derived item. Report the net profit/loss from the trading book in item 1.3.1 as the sum of item 1.3.1.1 and item 1.3.1.2. |

Item 1.3.1.1 | Report the net profit/loss from the trading book for the relevant period. |

Item 1.3.1.2 | Report any adjustments to net profit/loss from the trading book for previous periods. Item 1.3.1.2 is a derived item. Report the value of adjustments to net profit/loss from the trading book for previous periods in item 1.3.1.2 as the sum of item 1.3.1.2.1 and item 1.3.1.2.2. |

Item 1.3.1.2.1 | Report the value of any adjustments to net profit/loss from the trading book for previous periods due to mergers and/or acquisitions. |

Item 1.3.1.2.2 | Report the value of any adjustments to net profit/loss from the trading book for previous periods due to divestments. |

Item 1.3.2 | Report the net profit/loss from the banking book for the relevant period. Item 1.3.2 is a derived item. Report the net profit/loss from the banking book in item 1.3.2 as the sum of item 1.3.2.1 and item 1.3.2.2. |

Item 1.3.2.1 | Report the net profit/loss from the banking book for the relevant period. |

Item 1.3.2.2 | Report any adjustments to net profit/loss from the banking book for previous periods. Item 1.3.2.2 is a derived item. Report the value of adjustments to net profit/loss from the banking book in item 1.3.2.2 as the sum of item 1.3.2.2.1 and item 1.3.2.2.2. |

Item 1.3.2.2.1 | Report the value of any adjustments to net profit/loss from the banking book for previous periods due to mergers and/or acquisitions. |

Item 1.3.2.2.2 | Report the value of any adjustments to net profit/loss from the banking book for previous periods due to divestments. |

Item 2 | Report the business indicator. Item 2 is a derived item. Report the business indicator in item 2 as the sum of ILDC, SC, and FC: where: the interest, leases, and dividend component (ILDC) is calculated as: - the minimum of the interest component and the asset component, plus

- the dividend component; and

the services component (SC) is calculated as: - the other operating component plus the fee and commission component; and

the financial component (FC) is calculated as: - the trading book component plus the banking book component.

ILDC The interest component is calculated as the average of: - the absolute value of: item 1.1.1 (column 1) minus item 1.1.2 (column 1),

- the absolute value of: item 1.1.1 (column 2) minus item 1.1.2 (column 2), and

- the absolute value of: item 1.1.1 (column 3) minus item 1.1.2 (column 3).

The asset component is calculated as 2.25 per cent multiplied by the average of item 1.1.3 for columns 1, 2, and 3. The dividend component is calculated as the average of item 1.1.4 for columns 1, 2, and 3. SC The other operating component is calculated as the maximum of: - the average of item 1.2.3 for columns 1, 2, and 3, and

- the average of item 1.2.4 for columns 1, 2, and 3.

The fee and commission component is calculated as the maximum of: - the average of item 1.2.1 for columns 1, 2, and 3, and

- the average of item 1.2.2 for columns 1, 2, and 3.

FC The trading book component is calculated as the average of the absolute value of item 1.3.1 for columns 1, 2, and 3. The banking book component is calculated as the average of the absolute value of item 1.3.2 for columns 1, 2, and 3. |

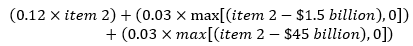

Item 3 | Report the operational risk regulatory capital requirement as calculated. Item 3 is a derived item. Report the operational risk regulatory capital as calculated in item 3 as: - 12 per cent of item 2, plus

- if item 2 exceeds $1.5 billion, 3 per cent of the amount by which item 2 exceeds $1.5 billion, plus

- if item 2 exceeds $45 billion, 3 per cent of the amount by which item 2 exceeds $45 billion.

The formula for item 3 is:

|