1 Name

This instrument is the Corporations (Fees) Amendment (Takeovers) Regulations 2024.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | 1 January 2025. | 1 January 2025 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Corporations (Fees) Act 2001.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Corporations (Fees) Regulations 2001

1 Regulation 1B

Insert:

control transaction has the meaning given by regulation 4B.

Part 5.1 arrangement has the meaning given by subregulation 4(2).

regulation 4 body has the meaning given by subregulation 4(3).

threshold value:

(a) for a lodgement under subsection 411(10) or 601GC(2) of the Corporations Act—has the meaning given by regulation 4C of these Regulations; and

(b) for a lodgement under paragraph 661B(1)(b) or 662B(1)(b) of the Corporations Act—has the meaning given by regulation 4F of these Regulations.

2 Before regulation 3

Insert:

Division 1—Schedules 1 and 2

3 Regulation 3 (heading)

Omit “Prescribed fees—”.

4 Subregulation 3(1) (note)

Omit “regulations 5, 6, 9A and 9B”, substitute “Divisions 2 and 3 of this Part”.

5 After regulation 3

Insert:

Division 2—Fees relating to certain Part 5.1 arrangements, trust schemes and takeover bids

Subdivision A—Part 5.1 arrangements

4 Fee—Part 5.1 arrangements

(1) For the purposes of section 5 of the Act, and subject to regulation 4H of these Regulations, the fee set out in subregulation (4) of this regulation is prescribed for lodging under subsection 411(10) of the Corporations Act a copy of an order of approval of a Part 5.1 arrangement in relation to a regulation 4 body, if:

(a) the Part 5.1 arrangement is, or is part of, a control transaction in relation to the regulation 4 body; and

(b) the threshold value for the lodgement is equal to or greater than $10 million; and

(c) the lodgement occurs between 1 January 2025 and 31 December 2027.

(2) A Part 5.1 arrangement in relation to a regulation 4 body is a compromise or arrangement under Part 5.1 of the Corporations Act between the regulation 4 body and its members, or a class of its members.

(3) A regulation 4 body is:

(a) a listed company; or

(b) an unlisted company with more than 50 members; or

(c) a listed registrable Australian body that is registered under Division 1 of Part 5B.2 of the Corporations Act.

(4) For the purposes of subregulation (1), the fee is the fee worked out using the following table:

Fee |

Item | Column 1 If the threshold value for the lodgement is … | Column 2 then the fee is … |

1 | greater than $500 million | $195,000. |

2 | (a) less than or equal to $500 million; and (b) equal to or greater than $100 million | $145,000. |

3 | (a) less than $100 million; and (b) equal to or greater than $35 million | $50,000. |

4 | (a) less than $35 million; and (b) equal to or greater than $10 million | $10,000. |

4A Fee—trust schemes

(1) For the purposes of section 5 of the Act, and subject to regulation 4H of these Regulations, the fee set out in subregulation (2) of this regulation is prescribed for lodging under subsection 601GC(2) of the Corporations Act a copy of a modification of the constitution of a listed registered scheme or a new constitution of a listed registered scheme, if:

(a) the modification, or the repeal and replacement, of the constitution of the registered scheme is part of a control transaction in relation to the scheme; and

(b) the threshold value for the lodgement is equal to or greater than $10 million; and

(c) the lodgement occurs between 1 January 2025 and 31 December 2027.

(2) For the purposes of subregulation (1), the fee is the fee worked out using the following table:

Fee |

Item | Column 1 If the threshold value for the lodgement is … | Column 2 then the fee is … |

1 | greater than $500 million | $195,000. |

2 | (a) less than or equal to $500 million; and (b) equal to or greater than $100 million | $145,000. |

3 | (a) less than $100 million; and (b) equal to or greater than $35 million | $50,000. |

4 | (a) less than $35 million; and (b) equal to or greater than $10 million | $10,000. |

4B Meaning of control transaction

Regulation 4 bodies

(1) One or more Part 5.1 arrangements in relation to a regulation 4 body constitute a control transaction in relation to the regulation 4 body if the Part 5.1 arrangement or arrangements result in:

(a) a person beginning to control the regulation 4 body; or

(b) the voting power of a person in the regulation 4 body increasing:

(i) from 50% or below to more than 50%; or

(ii) from a starting point that is above 50%.

(2) However, one or more Part 5.1 arrangements are not a control transaction if:

(a) their sole object is to exchange securities in the regulation 4 body for securities in a body or managed investment scheme (the new body) in such a way that subregulation (3) applies; or

(b) they are, or are part of, an internal restructure or reorganisation of a group of persons who are:

(i) related bodies corporate; or

(ii) related by means of trust or partnership.

(3) This subregulation applies if, immediately after the exchange, the voting power in the new body of each person who was:

(a) if the Part 5.1 arrangement, or any of the Part 5.1 arrangements, are with all of the members of the regulation 4 body—a member of the regulation 4 body immediately before the exchange; or

(b) if the Part 5.1 arrangement, or all of the Part 5.1 arrangements, are with a class or classes of members of the regulation 4 body—a member of that class or any of those classes;

is the same as the voting power the member had in the regulation 4 body immediately before the exchange.

Listed registered schemes

(4) An arrangement is a control transaction in relation to a listed registered scheme if the arrangement results in:

(a) a person beginning to control the registered scheme; or

(b) the voting power of a person in the registered scheme increasing:

(i) from 50% or below to more than 50%; or

(ii) from a starting point that is above 50%.

(5) For the purposes of paragraph (4)(a) of this regulation, in working out whether a person begins to control the registered scheme, apply section 50AA of the Corporations Act with the modifications set out in paragraphs 604(1)(a) to (h) of that Act in relation to the registered scheme.

4C Meaning of threshold value

(1) This regulation applies to a control transaction in relation to:

(a) a regulation 4 body; or

(b) a listed registered scheme.

(2) For the purposes of this regulation, a security is:

(a) a share in the regulation 4 body; or

(b) an interest in the listed registered scheme;

other than a share or interest issued under the control transaction.

(3) The threshold value for:

(a) a lodgement under subsection 411(10) of the Corporations Act of a copy of an order of approval of a Part 5.1 arrangement in relation to the regulation 4 body that is, or is part of, the control transaction; or

(b) if the control transaction includes a modification of the constitution of the listed registered scheme, or the repeal and replacement of the constitution of the listed registered scheme—a lodgement under subsection 601GC(2) of the Corporations Act of a copy of the modification, or a copy of the new constitution of the listed registered scheme;

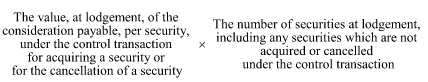

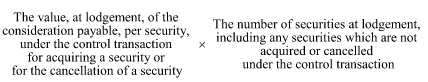

is the amount worked out using the following formula:

(4) If the control transaction provides for the acquisition or cancellation of securities in only one class of securities, treat a reference in subregulation (3) to a security as being a reference to a security of that class.

(5) If the control transaction provides for the acquisition or cancellation of securities in 2 or more classes of securities, work out the threshold value for the lodgement by:

(a) applying the formula in subregulation (3) to work out an amount in respect of each of those classes, treating a reference in that formula to a security as being a reference to a security in that class; and

(b) adding up the amounts worked out under paragraph (a) of this subregulation.

Subdivision B—Takeover bids

4D Fee—compulsory acquisition notices

(1) For the purposes of section 5 of the Act, and subject to regulation 4H of these Regulations, the fee set out in subregulation (2) of this regulation is prescribed for lodging a notice under paragraph 661B(1)(b) of the Corporations Act relating to a compulsory acquisition of securities following a takeover bid, if:

(a) the threshold value for the lodgement is equal to or greater than $10 million; and

(b) the lodgement occurs between 1 January 2025 and 31 December 2027.

(2) For the purposes of subregulation (1), the fee is the fee worked out using the following table:

Fee |

Item | Column 1 If the threshold value for the lodgement is … | Column 2 then the fee is … |

1 | greater than $500 million | $194,198. |

2 | (a) less than or equal to $500 million; and (b) equal to or greater than $100 million | $144,198. |

3 | (a) less than $100 million; and (b) equal to or greater than $35 million | $49,198. |

4 | (a) less than $35 million; and (b) equal to or greater than $10 million | $9,198. |

4E Fee—notices of right to be bought out

(1) For the purposes of section 5 of the Act, and subject to regulation 4H of these Regulations, the fee set out in subregulation (2) of this regulation is prescribed for lodging a notice under paragraph 662B(1)(b) of the Corporations Act relating to a right to buy out holders of bid class securities following a takeover bid, if:

(a) the threshold value for the lodgement is equal to or greater than $10 million; and

(b) the lodgement occurs between 1 January 2025 and 31 December 2027.

(2) For the purposes of subregulation (1), the fee is the fee worked out using the following table:

Fee |

Item | Column 1 If the threshold value for the lodgement is … | Column 2 then the fee is … |

1 | greater than $500 million | $194,359. |

2 | (a) less than or equal to $500 million; and (b) equal to or greater than $100 million | $144,359. |

3 | (a) less than $100 million; and (b) equal to or greater than $35 million | $49,359. |

4 | (a) less than $35 million; and (b) equal to or greater than $10 million | $9,359. |

4F Meaning of threshold value

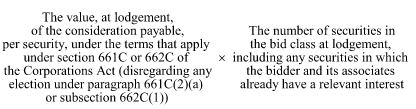

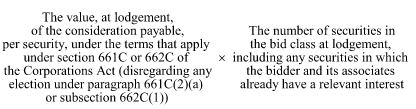

(1) The threshold value for a lodgement under paragraph 661B(1)(b) or 662B(1)(b) of the Corporations Act relating to a takeover bid is the amount worked out using the following formula:

(2) If 2 or more takeover bids, by the same bidder, for securities in the same target occur together, work out the threshold value for a lodgement under paragraph 661B(1)(b) or 662B(1)(b) of the Corporations Act relating to any of those bids by:

(a) applying the formula in subregulation (1) of this regulation to work out an amount in respect of each of those bids (including any bid in relation to which a notice is not lodged under paragraph 661B(1)(b) or 662B(1)(b) of the Corporations Act); and

(b) adding up the amounts worked out under paragraph (a) of this subregulation.

4G Fees are additional to fees prescribed by Division 1

To avoid doubt, a fee prescribed by this Subdivision for a lodgement is in addition to any fee prescribed by Division 1 for the lodgement.

Subdivision C—Only one fee prescribed for arrangements involving multiple chargeable matters

4H Only one fee prescribed for arrangements involving multiple chargeable matters

Part 5.1 arrangements

(1) If:

(a) a control transaction in relation to a regulation 4 body consists of more than one Part 5.1 arrangement; and

(b) a fee prescribed by Subdivision A for lodging a copy of an order of approval of one of the Part 5.1 arrangements is paid;

no fee is prescribed by that Subdivision for lodging a copy of an order of approval of any of the other Part 5.1 arrangements.

Takeover bids

(2) If a fee prescribed by Subdivision B for lodging a notice relating to a takeover bid is paid, no fee is prescribed by that Subdivision for lodging another notice relating to the takeover bid.

Example: If the fee prescribed by subregulation 4D(1) is paid for lodging a notice under paragraph 661B(1)(b) of the Corporations Act relating to a compulsory acquisition of securities following a takeover bid, no fee is prescribed by Subdivision B of this Division for lodging a notice under paragraph 662B(1)(b) of the Corporations Act relating to a right to buy out holders of bid class securities following the bid.

(3) If:

(a) 2 or more takeover bids, by the same bidder, for securities in the same target occur together; and

(b) a fee prescribed by Subdivision B for lodging a notice relating to one of the takeover bids is paid;

no fee is prescribed by that Subdivision for lodging a notice relating to any of the other takeover bids.

Arrangements involving multiple control transactions or takeover bids etc.

(4) If:

(a) an arrangement (within the meaning of Chapter 7 of the Corporations Act) includes:

(i) 2 or more control transactions; or

(ii) 2 or more takeover bids for securities in different targets; or

(iii) a control transaction and a takeover bid; and

(b) a fee prescribed by this Division is paid for lodging:

(i) a copy of an order of approval of a Part 5.1 arrangement that is, or is part of, any of those control transactions; or

(ii) a copy of a modification of the constitution of a listed registered scheme or a new constitution of a listed registered scheme, if the modification, or the repeal and replacement, of the constitution of the registered scheme is part of any of those control transactions; or

(iii) a notice relating to any of those takeover bids;

no fee is prescribed by this Division for lodging:

(c) a copy of an order of approval of a Part 5.1 arrangement that is, or is part of, any of those control transactions (other than, if subparagraph (b)(i) of this subregulation applies, the copy mentioned in that subparagraph); or

(d) a copy of a modification of the constitution of a listed registered scheme or a new constitution of a registered scheme, if the modification, or the repeal and replacement, of the constitution of the listed registered scheme is part of any of those control transactions (other than, if subparagraph (b)(ii) of this subregulation applies, the copy mentioned in that subparagraph); or

(e) a notice relating to any of those takeover bids (other than, if subparagraph (b)(iii) applies, the notice mentioned in that subparagraph).

Division 3—Other fees