Table of Contents

Part 1—Preliminary 3

1 Name 3

2 Commencement 3

3 Authority 3

4 Repeals 3

5 Definitions 3

Part 2—Eligibility for crisis payment 5

6 Meaning of contacted the Department—pt 2 5

7 Eligibility for crisis payment—release from gaol or psychiatric confinement 5

8 Eligibility for crisis payment—extreme circumstances forcing departure from home 5

9 Eligibility for crisis payment—remaining in home after removal of family member for abusive behaviour 6

10 Crisis payment not payable in addition to disaster relief payment 6

Part 3—Claims for crisis payment 7

11 How to claim 7

12 Making of claim 7

13 Claimant must be in Australia 7

14 Claim may be withdrawn 7

15 Investigation of claim 7

Part 4—Deciding claims 8

16 Commission to decide claim 8

17 Grant of claim 8

18 Notifying claimant of decision on claim 8

19 Date of effect of decision 8

Part 5—Payment of crisis payments 9

20 Amount of crisis payment 9

21 Effect of garnishee or similar order 9

22 Crisis payments not payable in lawful custody 9

Part 6—Review of decisions 10

23 Request for review 10

24 Commission’s duty if request for review made 10

25 Written record of decision on review and copy to person who requested review 10

26 Review by Tribunal 10

27 Transitional—claims not decided before commencement day 11

Part 1—Preliminary

This instrument is the Veterans’ Entitlements (Special Assistance—Crisis Payments) Instrument 2025.

This instrument commences on the commencement of item 84 of Schedule 2 to the Administrative Review Tribunal (Miscellaneous Measures) Act 2025.

This instrument is made under section 106 of the Veterans’ Entitlements Act 1986.

The Veterans’ Entitlements (Special Assistance) Regulations 1999 is repealed.

Note Since the commencement of the Veterans’ Affairs Legislation Amendment (Miscellaneous Measures) Act 2014, schedule 1, subitem 61(2), those regulations have been in effect as a legislative instrument made by the Commission under subsection 106(1) of the Veterans’ Entitlements Act 1986.

Note: A number of expressions used in this instrument are defined in section 5Q of the Act, including the following:

(a) Commission

(b) energy supplement

(c) family member

(d) member of a couple

(e) Rate Calculator

(f) service pension.

(1) In this instrument:

Act means the Veterans’ Entitlements Act 1986.

claim means a claim for crisis payment.

claimant means the person by whom, or on whose behalf, a claim is made.

contacted the Department has the meaning given by section 6.

crisis payment means a payment under this instrument.

home means a person’s principal place of residence.

lawful custody means detention of a person in gaol, or in psychiatric confinement, because he or she has been charged with an offence.

liquid assets, of a person, means cash and readily realisable assets of the person, and of the person’s partner (if the person is a member of a couple), and includes:

- shares and debentures in a public company within the meaning of the Corporations Law; and

- amounts deposited with, or lent to, a bank or other financial institution by the person or partner (whether or not the amount can be withdrawn or repaid immediately); and

- amounts due, and able to be paid, to the person or partner by, or on behalf of, a former employer of the person or partner;

but does not include:

- an amount that is a qualifying eligible termination payment for Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act 1936.

Note: For qualifying eligible termination payment see subsections 27A(12) to (12C) of the Income Tax Assessment Act 1936.

pension entitlement means an age service pension, an invalidity service pension, a partner service pension or an income support supplement.

severe financial hardship means:

- for a person who is not a member of a couple—the value of the person’s liquid assets is less than the fortnightly amount, at the maximum payment rate, of the pension entitlement that is payable to the person; and

- for a person who is a member of a couple—the value of the person’s liquid assets is less than twice the fortnightly amount, at the maximum payment rate, of the pension entitlement that is payable to the person.

(2) In this instrument, the maximum payment rate of a pension entitlement payable to a person is the rate worked out using the Rate Calculator as follows:

Class of entitlement | Applicable Method statement steps |

service pension (not blind, not war widow/war widower—pensioner) | Method statement 1, Step 4 |

service pension (blind, not war widow/war widower—pensioner) | Method statement 2, Step 4 |

service pension (not blind, war widow/war widower—pensioner) | Method statement 1, Step 4 |

service pension (blind, war widow/war widower—pensioner) | Method statement 1, Step 4 |

income support supplement, not blind | Method statement 5, Step 4 |

income support supplement, blind | Method statement 1, Step 4 |

Part 2—Eligibility for crisis payment

(1) In this part, a person has contacted the Department if:

(a) the person, or someone else on the person’s behalf, contacted the Department; and

(b) the contact is about claiming a crisis payment; and

(c) the person is in Australia on the day the contact happens; and

(d) the person claims a crisis payment within 14 days after the day the contact happens; and

(e) the Department has a record of the contact.

(2) In this section:

contact includes contact by post, telephone, facsimile transmission or email.

(1) A person is eligible for a crisis payment if:

(a) the person is released after spending at least 14 days in lawful custody; and

(b) the person contacts the Department or claims the crisis payment within 7 days after being released; and

(c) on the day on which the contact happens or the claim is lodged the person is:

(i) in severe financial hardship; and

(ii) a person who receives a pension entitlement.

(1) A person is eligible for a crisis payment if:

(a) the person has left, or cannot return to, their home because of an extreme circumstance; and

(b) the extreme circumstance makes it unreasonable to expect the person to remain in, or return to, the home; and

(c) the person has established, or intends to establish, a new home; and

(d) the person was in Australia when the extreme circumstance happened; and

(e) the person contacts the Department, or claims the crisis payment, within 7 days after the extreme circumstance happened; and

(f) on the day on which the contact happens, or the claim is lodged, the person:

(i) is in severe financial hardship; and

(ii) has made a claim (whether on the same day or on an earlier day) for a pension entitlement and is eligible for the pension entitlement; and

(g) in the 12 months before the day on which the claim is made, not more than 3 crisis payments for which the person was eligible under this section or section 9 have been payable to the person.

Note Examples of extreme circumstances which would deem a person eligible for a crisis payment include situations where the person’s house is burnt down, or where the person is subjected to domestic or family violence.

(2) For paragraph (1)(e), an extreme circumstance that is a continuing circumstance is taken to have happened when the circumstance first happened.

(3) A person is not eligible for a crisis payment for an extreme circumstance if the Commission is satisfied that the extreme circumstance was brought about to obtain a crisis payment.

(1) A person is eligible for a crisis payment if:

(a) the person has been subjected in Australia to domestic or family violence by a family member of the person; and

(b) at the time of the violence the person was living with that family member; and

(c) the family member leaves, or is removed from, the person’s home because of the violence; and

(d) the person remains living in the person’s home after the family member leaves or is removed; and

(e) the person’s home is in Australia; and

(f) the person contacts the Department, or claims the crisis payment, within 7 days after the day on which the family member leaves or is removed; and

(g) on the day on which the contact happens, or the claim is lodged, the person:

(i) is in severe financial hardship; and

(ii) has made a claim (whether on the same day or on an earlier day) for a pension entitlement and is eligible for the pension entitlement; and

(h) in the 12 months before the day on which the claim is made, no more than 3 crisis payments for which the person was eligible under this section or section 8 have been payable to the person.

(2) A person is not eligible for a crisis payment if the Commission is satisfied that the family member left the person’s home to obtain a crisis payment.

(1) A crisis payment is not payable to a person for an extreme circumstance if the person is eligible for a disaster relief payment (however described) for the extreme circumstances.

(2) However, this section does not affect a person’s entitlement to a crisis payment for an extreme circumstance if:

(a) the person has claimed the crisis payment; and

(b) the person subsequently qualifies for an Australian Government Disaster Recovery Payment or other disaster relief payment for the same extreme circumstance.

(3) In this section:

Australian Government Disaster Recovery Payment—see subsection 23(1) of the Social Security Act 1991.

Note Special assistance is also not payable in circumstances in which a person is also eligible for an allowance or assistance under another provision of the Act (see the Act, paragraph 106(2)(a)).

Part 3—Claims for crisis payment

(1) A person who wants a crisis payment must make a proper claim.

(2) To be a proper claim, a claim must be:

(a) in writing; and

(b) in accordance with a form approved by the Commission; and

(c) accompanied by any evidence reasonably available to the claimant that is relevant to the claim.

(1) To be a proper claim, a claim must be lodged:

(a) at an office of the Department or a place approved by the Commission; or

(b) with a person approved for the purpose by the Commission.

(2) A place or person approved under paragraph (1)(a) or (b) must be a place or person in Australia.

(3) A person may make a claim on behalf of another person.

A claim for a crisis payment is not a proper claim unless the claimant is in Australia on the day on which the claim is lodged.

(1) A claimant for a crisis payment or someone else on behalf of a claimant may withdraw a claim that has not been decided.

(2) A claim that is withdrawn is taken to have not been made.

(3) A withdrawal may be made orally or in writing to the Department.

(4) The Department must make a written record of a withdrawal that is made orally.

(5) A person withdrawing a claim on behalf of a claimant must be authorised in writing by the claimant to act on behalf of the claimant.

(1) If a person lodges a proper claim for a crisis payment, the Secretary must investigate the claim.

(2) When the investigation is finished, the Secretary must submit the claim to the Commission for decision.

(3) A claim submitted to the Commission must be accompanied by:

(a) any evidence submitted by the claimant with the claim; and

(b) any documents relevant to the claim that are under the control of the Department, including any evidence or documents relevant to the claim obtained during the investigation.

Part 4—Deciding claims

(1) The Commission must decide a claim submitted to it by the Secretary under subsection 15(2).

(2) When the Commission decides a claim, it must make a written record of the decision.

The Commission may decide to grant a claim if it is satisfied that:

(a) the person by, or for, whom the claim is made is eligible for a crisis payment; and

(b) the crisis payment is payable.

Note See section 10 for circumstances in which a crisis payment is not payable.

When a claim is decided, the Commission must notify the claimant, in writing, of:

(a) the decision; and

(b) the reasons for the decision; and

(c) the claimant’s right, if dissatisfied with the decision, to request the Commission to review the decision.

(1) This section applies to a decision under section 16 or 26.

(2) The Commission may state any of the following as the day the decision takes effect:

(a) the day the decision is made;

(b) a day before or after the day mentioned in paragraph (a).

Part 5—Payment of crisis payments

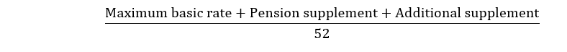

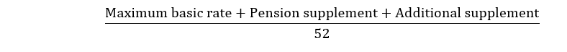

The amount of a crisis payment payable to a person is the amount worked out using the following formula:

where:

Additional supplement is either:

(a) the energy supplement added to the person’s maximum basic rate of service pension under Module BB of the Rate Calculator; or

(b) if paragraph (a) does not apply to the person—an amount that is equivalent to the amount that would have been added to the person’s maximum basic rate of pension entitlement under paragraph (a) if the person’s pension entitlement had been a service pension.

Maximum basic rate is the rate of the person’s pension entitlement, worked out in accordance with Module B of the Rate Calculator.

Pension supplement is the supplement for the person’s maximum basic rate, worked out in accordance with Module BA of the Rate Calculator.

Note 1 A person to whom a crisis payment is payable may request the Commission to approve paying the payment to another person specified in the request (see the Act, section 122).

Note 2 The Commission may direct the whole or a part of a crisis payment be paid to the credit of a bank account maintained by the person to whom the payment is payable, whether alone, jointly or in common with another person (see the Act, section 122A).

Note 3 A person may request the Commission to deduct certain payments from an instalment of a crisis payment (see the Act, section 122B).

A garnishee order or similar order does not apply to the amount of a crisis payment in an account kept with a financial institution if:

(a) the crisis payment was paid to the credit of the account in the 4 weeks before the order came into force; and

(b) the crisis payment was payable to the person whose account it is (whether on the person’s own behalf or not).

A crisis payment is not payable to a person on a day on which the person is in lawful custody.

Part 6—Review of decisions

(1) A claimant who is dissatisfied with a decision of the Commission under Part 4, or another person on a claimant’s behalf, may request the Commission to review the decision.

(2) A request for review must:

(a) be in writing; and

(b) set out the grounds on which the request is made; and

(c) be lodged with the Commission within 3 months after the day on which the person seeking review was notified of the decision.

(1) If the Commission receives a request under section 23 for review of a decision, the Commission must review the decision:

(a) within 3 months after the day on which the request was lodged; or

(b) within a longer period agreed in writing by the person who made the request.

(2) On review of a decision, the Commission must:

(a) affirm the decision; or

(b) set the decision aside.

(3) If the Commission sets aside a decision, it must make a decision in place of the decision set aside.

(4) A person to whom the Commission has delegated its power to review decisions under this section must not review a decision if that person made the decision under review.

(1) When the Commission reviews a decision, it must:

(a) make a written record of the decision made on review; and

(b) give a copy of the written record to the person who requested review.

(2) The written record must:

(a) set out the Commission’s findings on relevant questions of fact; and

(b) refer to the evidence or other material on which the findings are based; and

(c) give reasons for the decision made on review.

(1) An application may be made to the Tribunal for a review of a decision of the Commission under section 24.

(2) Despite anything else prescribed under subsection 18(1) of the ART Act, the person may apply to the Tribunal for review of the decision within 3 months after the day on which the person seeking review is given a record of the decision under paragraph 25(1)(b).

(3) To remove any doubt, subsection (2) does not affect subsection 18(2) and section 19 of the ART Act.

(4) In this section:

ART Act means the Administrative Review Tribunal Act 2024.

Tribunal means the Administrative Review Tribunal established under section 8 of the ART Act.

(1) This section applies to a claim:

(a) made in accordance with the old instrument; and

(b) that had not been decided by the Commission immediately before the commencement day.

- This instrument applies in relation to the claim as if the claim were made in accordance with Part 3.

- In this section:

commencement day means the day section 4 commences.

old instrument means the Veterans' Entitlements (Special Assistance) Regulations 1999.

Note 1 Item 20 of Schedule 16 to the Administrative Review Tribunal (Consequential and Transitional Provisions No. 1) Act 2024 deals with the right of a person to make an application to the Administrative Appeals Tribunal that existed before 14 October 2024.

Note 2 Item 24 of Schedule 16 to the Administrative Review Tribunal (Consequential and Transitional Provisions No. 1) Act 2024 deals with a proceeding in the Administrative Appeals Tribunal that had not been finalised before 14 October 2024.